#14 ESG Risk and Strategic Implications of Facebook's Commerce Outlook (Q2 2021 Earnings)

Explores the impact of Facebook's focused strategy on Commerce, my hypothesis on hyperlocalisation, the Nash Equilibrium point, the ESG impact, & potential scenarios of the landscape of marketplaces.

Before I begin, I want to thank all the readers of my last edition of this newsletter on the strategic outlook of e-RUPI. I got a multifold jump in views (week on week average), and it became my most viewed post to date.

As I reflect upon the success of that post, I want to highlight some aspects of my journey of the past few weeks:

I am yet to figure out my audience. The current lot is a mix of mid-to-senior management and CXO level executives in the business and startup ecosystem.

I write analysis pieces (say Stratechery or Howards Marks’ memos), rather than information pieces (The Ken, Entracker, Morningstar). I try and focus on things not reported by mainstream media, and provide an abstract version of some deep analysis of the said topic.

I try and maintain a balance between incorporating reflective analysis and predictive forward-looking sections.

Some off-track deviations from the analysis into predictions and game theory are my attempts to satisfy an intellectual itch. This is one section that most readers overlook and ignore, for all the good reasons.

In my writings, I emulate a lot of the work done by Howard Marks’ memos (Oaktree Capital), Ben Thompson and Stratechery, Matt Levine (Money Stuff), Andrew Ross Sorkin (Dealbook), Shira Ovide (On Tech), Eric Newcomer (Newcomer), Marc Rubenstein (Netinterest), Adam Tooze (Chartbook), Benedict Evans (Essays and Newsletters), and Shane Parrish (Farnam Street).

While I figure out how to get better at writing and engagement, I pray for your continued support and feedback in this journey.

Coming back to the topic at hand.

Hide the tree in a forest - FB’s Announcement on Commerce and Marketplaces

On Wednesday, July 28 2021, Facebook announced their Q2 earnings for the year. Two sections within their investor slides and their earnings call transcript caught my attention and stood out almost immediately. What hit me was the mind-numbing impact and the future potential of the platform that is silently transforming our lives without the ecosystem media, governments, regulators, and businesses catching up. I had just finished the book called “An Ugly Truth: Inside Facebook's Battle for Domination” by Cecilia Kang and Sheera Frenkel, one of the best reads of 2021. So the impact was even more so. Lets dig-in.

Point 1: A stunning 35% of the world is daily active user for the Facebook Family.

Assuming the world’s population being 7.88 Billion in 2021, 2.76 people are active on Facebook or one of its apps - Instagram, Messenger, or Whatsapp. Daily.

The crawly tentacles of the platform have stretched to include interactions with “FB Like” or sharing on Instagram/Messenger/Whatsapp, or to now even payments and engagement with FB videos.

We define a daily active person (DAP) as a registered and logged-in user of Facebook, Instagram, Messenger, and/or WhatsApp (collectively, our "Family" of products) who visited at least one of these Family products through a mobile device application or using a web or mobile browser on a given day.

- Facebook Official Definition

One way to look at this is also the spillover effects of each platform onto the other, the sheer size and scale of data collection, and the power of monetization of user’s attention to generate a revenue of USD 29 Billion or INR 2,16,020 Crores (from April to June, 2021). This is three times India's entire public health expenditure and two times India’s Agriculture expenditure (Open Budgets).

Anchor: To understand the full picture, Facebook earned USD 85.96 Billion or INR 6,40,316 Crores in 2020 (January to December 2020). They can buy some countries in alphabetical order, and then have some money left behind.

Point 2: Key Focus on Commerce in 2021, especially in India

Early on the earnings call with the investors and analysts, Mark Zuckerberg had the following to say:

Mark Zuckerberg declared commerce to be his major focus area, right after Creator Tools and preceding Metaverse. My hot take 🔥 on this is given in the following blurb.

The intention of Facebook is to expand its business offerings, through vertical integration. They wish to control the entire stack, with services provided by them at every layer of the stack.

The stack will include the following:

Listing: Enable business to list their products and services on the platform. This will become as simple as an Facebook/Instagram extension, with special fuctions for Whatsapp and Messenger that behave more like a visual dropdown/IVRS menu. If Facebook decides to really go the long-way and work on this properly, this will include services like business registerations, virtual business addresses, portfolio building, etc.

Engagement:Both on the business front as well as the user front, discovery is key to the process of both revenue generation and user engagement for the platform. The key operating word used by Mark Zuckerberg on the earnings call was “Personalised” or “Optimised”.

Discovery of Users for Businesses: This will include advertisement services for businesses to become more visible to the target customers.

Comparison of Businesses for Users: Predominantly for users, this will provide with various business options for the same search parameters.

Payments: This will include a host of services across payments, lending, and insurance. With Whatsapp pay being officially launched in India and Brazil (another huge market like India for Facebook), they are banking on UPI powered cross functional payments systems. This will also have easy integrations with BNPL (Buy Now Pay Later) and other services. Currently, Whatsapp Pay has partnerships with State Bank of India, HDFC, ICICI and Axis Bank.

Fulfillment: Here is where the things start getting tricky. I believe this will be a hybrid model, with third-party local-area fulfillment merchants playing a large role, along with integrations like Dunzo, Swiggy, Zomato, and other agent networks as well.

Shops, marketplaces, and business messaging will be the segments for development across the platforms. If you have stuck this far, the next section gets even better. We now go into why this changes the landscape of marketplaces, hyperlocalisation, and the Facebook advantage.

Business Impact and Implications of Commerce-focused Strategy by Facebook in India

When a platform that has 35% of the world announce its utter and complete focus on the commerce and marketplace segment, it is wise to pay attention. Currently, the segment of internet-based commerce has been dominated by players like Amazon, Flipkart, and Reliance. Here is where things change.

I make a distinction by using the term “internet-based commerce” rather than eCommerce. The difference is, one is a medium of commerce, the other is a way of commerce. I believe with this Commerce-first strategy, Facebook’s advantage includes the following points:

Zero Inventory Pure Marketplace: Adhering to the true definition of a marketplace, it just brings buyers, sellers, and service providers together on a virtual platform, providing its own services as well as other service integrations, all the while monetising and earning revenues.

Facebook will never have to worry about inventories of the products and services being traded and exchanged for the platform, neither will they have considerable costs handling Whatsapp payments, with bank partners sharing most of the load.

Products and Services: While Amazon, Flipkart, and now Reliance Retail look at capturing the ever expanding product-based marketshare of the retail sector, Facebook is looking at a larger ecosystem of people-centric business. One use-case in which the Marketplace feature has outperformed itself is the business of subletting of flats in India, bypassing the brokers. This is given a boost by one of the best advantages of Facebook as a platform w.r.t other competitors - User Generated Content.

Reviews and User Generated Content (UGC) for Commerce: One one the superior advantages that Amazon had till recent times was its user-generated content section for every product and SKU (stock keeping unit) being sold through the platform With Facebook, the volume of UGC will be up, something like having Amazon reviews section on steroids. The “Like” button is particularly useful to bridge the most difficult part of the UGC and reviews section of any platform - the accuracy and currency of information.

Advertisement: The people-centric (“personalized” as mentioned by Mark Zuckerberg) approach to online commerce, with high user engagement will prompt more accurate selection and targeted advertisement. We might just watch some of these companies get a advert-to-transactional revenue conversion over 10%.

Financial Profiles and Alternative Credit: For a local business is a tier 2-tier 3 city in India, a vintage of transactions across say 6 months or one year might then be processed into a unique credit score which the partner banks (HDFC, ICICI, SBI, Axis) can provide loans. This can also be integrated into third party services like Khatabook and other similar MSME/Small Business financial management and digitisation.

Hyperlocalisation of Online Commerce - People Centric Approach by Facebook

Last month, I wrote about Reliance’s strategy on flipping the table, focussing on a omnichannel approach of focussing on the short-tail of eCommerce.

With its expansion into the Omnichannel route, Reliance retail is spreading its wings, betting massively on local stores providing inventory for their eCommerce platform. In some ways, they are also pushing for hyper-localisation of eCommerce, reducing turnaround times, and providing a steady pipeline of customers for local businesses that till today relied on walk-in customers in physical stores.

By reducing the customer acquisition costs of stores, they aim to build an entire ecosystem around hyper-local eCommerce for customer’s more short-tailed needs - groceries, staples, fixtures, etc.

What this achieves in the Reliance eCommerce Flywheel, is lower cost structures. More localised delivery at a consistent rate will ensure costs per delivery do not blow out of proportion. This still constitutes a large part (about 40%) of the unit economics (cost-side) of any doorstep delivery service, be it Amazon, Zomato, D2C companies, or Reliance Retail.

Facebook is flipping the game on its axis, but on another plane and dimension. This differentiation will be come the key to Facebook’s moat (sustained competitive advantage) and will drive a very large chunk of the business, especially in an emerging market like India.

eCommerce players focus on products and services, and listing businesses that help provide those products and services. Product First, User Second.

Facebook takes a user-centric approach, which translates into expanding the basket of offerings to include localised point-to-point services, as well as a marketplace for local products.

Imagine you and your neighbour bake excellent cakes and prepare homemade chocolates. Withing your own Whatsapp contact list and FB friend list, you and your neighbour will be able to sell these cakes without the hassle of opening up a Shopify store, or putting it on any other platform.

I already mentioned the domain of house-hunting for new entrants in cities to be an excellent use-case. Other service based additions will include services listed under Urbanclap, Legal Services, Second Hand Markets (Olx and Quikr), Indiamart etc to name a few.

Local logistics service providers might want to gear up for no-hurry hassle free delivery, which the customers will gladly pay for, with same-day delivery being a norm in a lot of cases.

This will help incur very low customer acquisiton cost, and increase customer life-time value to never before seen levels.

The behavioural aspects such as trust and transparency will be managed by a stream of user-generated content. It might take about two years to build momentum and hit the critical threshold, but I belive this is how the ecosystem will evolve.

The aforementioned analysis on hyperlocalisation of online-commerce by Facebook raises the following critical points:

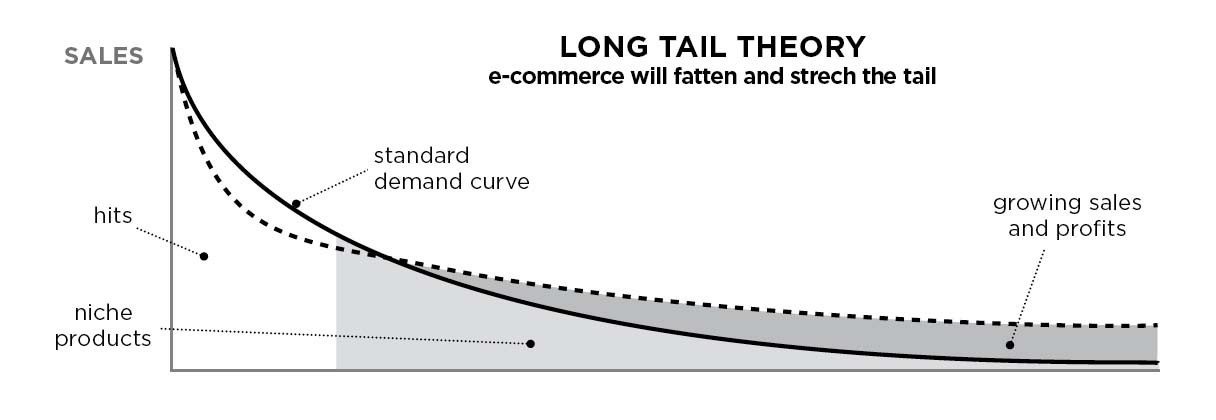

Long-Tail vs Short Tail: Hyperlocalisation by two of the largest players will have a multifold impact on the business ecosystem. It will target the short-tail of commerce, leaving the revenues towards the long-tail for the other competitors.

Customer Centric vs Product Centric: The economics of customer-centric strategy for Facebook trumps most of the other competitors.

Third Party Integration: In case of both Reliance and Facebook, there is a lot of scope of third-party integration. On one hand Reliance’s acquision of Just Dial gives it a good head start, with Facebook’s UGC efforts needing a completely new direction.

ESG Impact of Facebook’s Commerce-focused Strategy

I continue with the boundary conditions of ESG performance benchmarking I proposed in my previous newsletters (you can read more about it here), and look at the ESG risks of Facebook’s commerce-focused strategy.

Environment Parameters: Order Fulfilment will be done through direct point-to-point contact, or integration of third-party services. Facebook can incentivise environment friendly behaviour through reduction in commissions, or favourable highlights, or special mentions. All of which will drive traffic and create sensitisation towards more carbon efficient mechanisms. Facebook can also give preferential treatment to companies with environment friendly alternatives to commercial products, and promote them.

Social Parameters: I believe this commerce-first strategy will have a large impact in the domains of community investments, especially in the sectors of Livelihoods, Employment, Microentrepreneurship, Digital Access and Inclusion, and Financial Inclusion.

This will help unlock local markets and self-employment opportunities, even in rural areas of India where the penetration of Facebook is growing. Reducing the friction on setting up of shops on the Facebook Marketplace and teaching these entrepreneurs how to connect with people and sell their products will be a huge win. I believe this will drive a lot of rural consumption and economic growth.

Interesting second and third order effects of this strategy are the boost to the efforts in digital access and inclusion to the previously untapped market. This will also be done through assisted mode (say via networks like producer groups, SHGs, banking correspondents, health workers, etc), with institutions and civil society organisations playing a major role.

This will also drive a lot of digitisation of finance, prompting aggressive financial inclusion mechanism and behavioural push towards adopting digital financial services, which in turn will help ease access to complex products and services like lending and insurance.

Governance Parameters: There are three main areas to focus on for Facebook - Anti-Trust, Fraud Protection and Prevention, Customer Data Privacy and Protection.

Anti-Trust: It has more to do with preferential treatment of various sellers in marketplaces, as well as Facebook’s investment in Reliance’s Jio Platforms. It is my personal view that India’s competition law (especially The Competition Commission of India (Procedure in regard to the transaction of business relating to combinations) Regulations, 2011) needs a major overhaul, there is a lot of archaic and traditional business paradigms that continue to exist. The regulations are not yet adapted to platform based economics and implications of reaching out beyond what is traditionally called as “Market Share”.

Nash Equilibrium Point of Online Commerce - Amazon, Reliance, Flipkart, and Facebook vs the rest.

My prediction is the following nash equilibrium point in the months to come:

Long-tail: Amazon will rule the world in long-tail eCommerce. With omnichannel growth strategy including Amazon Saheli and Amazon Now, they will slowly enter short-tail products and service, and quick turn-around deliveries.

Reliance: Will takeover hyperlocal commerce, especially on the short-tail side of things, with larger long-tail products going towards offline commerce.

Flipkart-Whole Foods: They will gear up for an IPO and launch within the next 12 months or so, and directly compete with more long-tail products. There will be another equilibrium between Amazon, Reliance, and Flipkart on the long-tail.

B2B Online commerce: Organisations like Udaan will form a layer above this, with stable equilibrium based on the type of product. We will see emergence of players like Zomato Hyperpure in the mix as well.

Facebook: It will take over the hyperlocal commerce segment with ease, with more focus towards services led as well as person-to-person businesses. Focus areas will include Agriculture, Real Estate, Wealth Management and Advisory, local MSME and consumables industry, as well as retail. They will find an equilibrium with Reliance on the short-tail side of things, as well as achieve an equilibrium point with the likes of Urban Clap, Pepper Fry, India Filings, Housing.com, etc on the B2C services space.

Hyperlocal Delivery: Organisations like Delhivery, Ecom Express, Amazon Delivery Services, and EKart will find their equilibrium with a majority of market share. This will be followed by a lot of democratisation of services, mostly to local city-level players.

Payments and Support: Amazon Pay, Phone Pe, Jio Payments Bank, and Whatsapp Pay will find the equilibrium point based on their individual platform associations. However, we might find Whatsapp Pay being a more prevalent option just because of the pervasiveness of the platform.

Semi-Final Word

The implications of Facebook’s commerce-focused strategy is far and wide. We have to be careful in understanding the ESG risks that this brings about, and how best to mitigate some of it in the months to come. I believe space of community investments in livelihoods and entrepreneurship will see a big boost due to this strategy. It will be super interesting to see how this space unfolds in the months to come.

https://gotosmmpanel.com/