#13 Decoding e-RUPI by NPCI - A Strategic Outlook

Explores the strategic implications of eRUPI for various stakeholders, the operating mechanisms of eRUPI, & the expected nash equilibrium point. Also explores cash management and accounting advantages

Last week saw the launch of e-RUPI, a person and purpose-specific digital payment solution, managed by the National Payments Commission of India (NPCI). Through this edition of my newsletter, I provide a strategic outlook on the potential of e-Rupi to become a game-changer for both the Government and private sector companies, and the implications for consumers, and communities. I also shed some light on the operating mechanism of e-RUPI, and some of the strategic implications of the introduction of such systems.

e-RUPI was launched with pomp and show by our prime minister on 2nd August, 2021. The intended rationale for the programme was to ensure monetary benefits reach its intended beneficiaries in a targeted and leak-proof manner, with limited touchpoints between the government and the beneficiary. This is projected to be the next step in the evolution of direct benefit transfers (DBTs), the most prevalent model for disbursement of social security benefits in India. To keep a levelled playing field, the operationalisation of e-RUPI incorporated an SMS string-based component for feature phones widely used in rural areas.

The True Power of e-RUPI: Cash Management, Accounting, and Scope Limits

A lot has been written on the aspects of fungibility, and its potential of becoming a precursor to RBI’s digital currency initiative. Most of this logical progression comes from the aspect of “removing intermediaries” e-RUPI, a strong value proposition widely used domain of Blockchain systems (and by extension, Cryptocurrency systems).

In my view, none of these reasons come close to the actual power of e-RUPI, which in itself will transform the entire landscape of targeted payments across both public markets and private markets.

I would like to focus on two main components of the aforementioned tweet by the Prime Minister’s office - Targeted and Transparent.

Conditional Cash Transfers has been the bedrock of our social security mechanism across various departments, widely used in areas of agriculture, rural development, and health and nutrition to name a few.

Some of the gaps with this system included the following:

The usage of “Cash” in the targeted domain

Allocated yet unspent money earmarked for specific budgets

High operational cost for maintenance and distribution of benefits on the final mile - both technology and manpower

The limited scope of public-private partnerships in leveraging domain-specific benefits, especially on the Government side - like fertilisers, health care providers, etc.

e-RUPI solves the problem of “Targeting”, ensuring that customers and communities leverage the money only for the determined specific use of the SMS/QR-code based token. In this way, the government can engage in partnerships even with private entities in providing additional targeted benefits to the consumers. Some of the key advantages of this mechanism include:

The onus of management of the delivery mechanism falls more on the side of the merchants, and not the service provider.

The cost of accessing the benefit for the consumer does not increase or decrease per se. In my view, if improperly used, thus increasing the friction of accessing benefits.

This saves the service providers an insane sum of money, as their primary incentive is to identify the beneficiary and find a merchant that will provide the benefits. The money only gets deducted from the service provider’s account when the consumer actually redeems the benefits at the merchant, and not otherwise.

This prevents improper use of the benefits for other purposes. This is a disadvantage, especially for low-income rural communities.

From an accounting perspective, the service providers can show the unspent budget allocation on their books in a much better light (savings rather than expenses).

From a PR perspective, one can always say the service provider has reached out to “x Million people”, rather than focusing on the actual number of people benefitting from this.

The focus shifts on easing service delivery, and not service adoption. I personally am against this approach, as it rarely if not never benefits the consumer. So much so for “human-centered design”.

It also adds a significant value to government revenues in terms of unutilised benefits across multiple schemes. This is particularly true for the domains in agriculture and healthcare.

There is a possibility this might be pervasive, transforming the very benefits being provided through social security like education, work, pension, healthcare, etc.

If we shift our perspective from Government to the private sector, this becomes an innovation of massive proportions for companies.

Instead of providing cash in various components within our monthly salaries, they might provide with SMS/QR-Code based merchant-linked coupons for anything and everything. This is a significant diversion in HR practices that might just be round the corner.

The cash-management and accounting benefits that this service provides are much more than any other quality proposed and marketed by NPCI or the government.

Implications of e-RUPI

Some of the strategic implications of e-RUPI are provided below:

NGOs and Non-Profits: Nothing much changes on this front. A majority of the work will still continue to be on the part of unlocking the customer access and adoption of social security and other government-led benefits.

Companies: After minimal testing, some of the earlier allocations for health, food, rent, etc might shift to an e-RUPI mechanism. This might lead to a significant shift in salary structures and employment benefits, along with a sizeable improvement in financial management and accounting of some of the employee-related expenses and other benefits-related expenses for the companies.

Government: I predict major shifts in subsidies and other benefits-based schemes across various departments. Agriculture and healthcare going first, followed by a transformation in the departments pertaining to Rural Development, Skill Development and Entrepreneurship, MSMEs, Startup India, and Education.

Banking Sector: The details are fuzzy at the moment as to the transactional details and incentives for e-RUPI for banks and other financial institutions on the issuing and processing side. However, this does provide a lot of digitisation of expenditure for its customers, that might be used for alternative credit rating mechanisms, and upselling and cross-selling of various financial services products, primarily focussed on insurance and lending.

Merchants: The opportunities are limitless. We will have to see how the landscape evolves. The balance of power however lies with the service provider. We might observe some strategic partnerships to leverage e-RUPI in the near future.

Consumers: I feel for the consumers, as they draw the shortest stick in the bundle. The costs for acquisition, access, and adoption for e-RUPI on the customer side might increase, if not remaining the same. This is a mechanism primarily for the service providers, and not the consumers.

Nash Equilibrium Point: Each of the aforementioned players will contribute to reaching an optimum nash equilibrium point.

Service providers will rule the block, with maximum payoffs and fewer risks. The burden will be shared by merchants, who will also have good payoffs. Customers will have no choice but to use this as this is more from supply-side perspective, and primarily focussed on critical one-time large payoffs. There is only so much a customer is able to do, but to comply and fit into the equilibrium point set by the service providers and merchants. The banking sector will only facilitate transactions based on fixed commission structures, thereby having no incentives to push for any direct innovation. They will continue to support the equilibrium point as they have a potential for upselling and cross selling, as well as almost free digital data records of potential consumers who may or may not be affiliated to the bank.

Operationalisation of e-RUPI

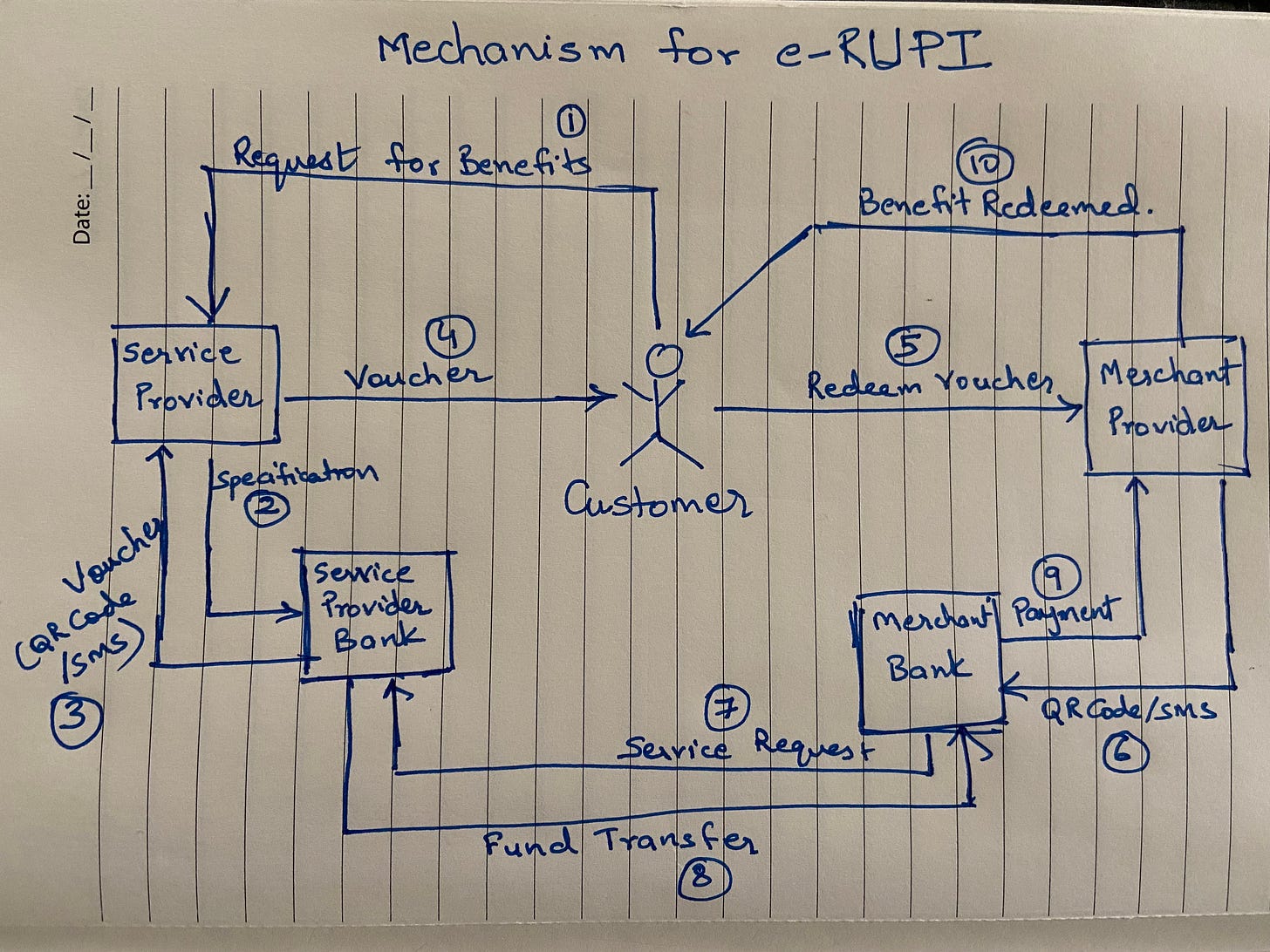

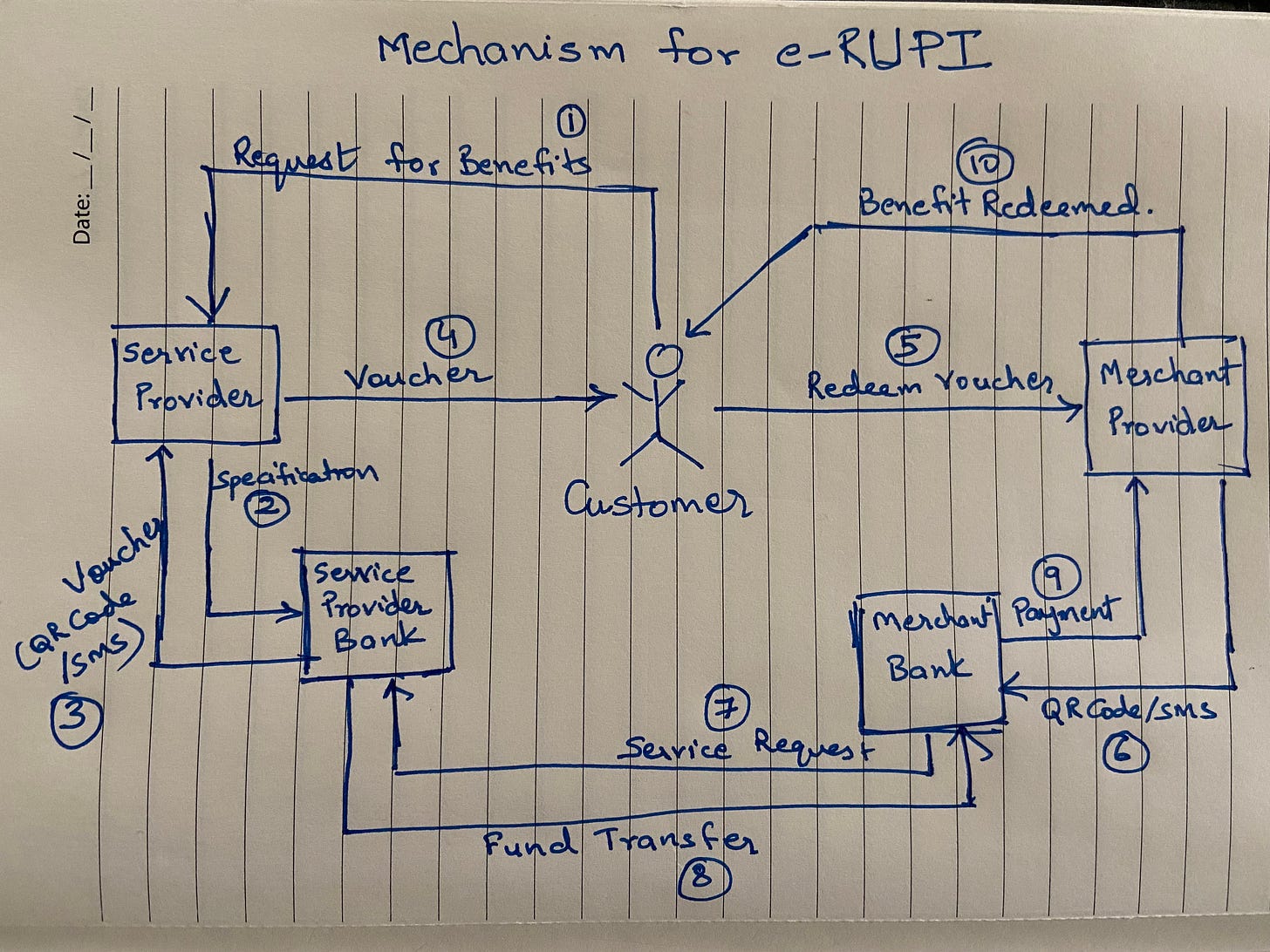

Some of the saliet features on the operationalisation of e-RUPI are captured in the illustration below:

Mode of Delivery: It is a QR code or SMS string-based e-Voucher, which is delivered to the mobile of the beneficiaries. This may happen via Whatsapp/SMS as well as email.

Mobile Number receiving the SMS string is linked to the Bank Account.

Voucher Redemption: A one-time payment mechanism will be able to redeem the voucher without a card, digital payments app or internet banking access, at the service provider.

Issuer (bank) affiliated with the service provider. The merchant is also linked to the bank.

Removal of intermediaries: Cost of intermediation is removed, making it decentralised. Build on the tenets and precepts of Blockchain, however, this will be just an end-to-end transaction.

It connects sponsors of the services with the beneficiaries and service providers in a digital manner without any physical interface.

Prepaid: Being pre-paid in nature, it assures timely payment to the service provider without the involvement of any intermediary.