#8 ESG Performance Benchmarking Framework and Impact on Business Strategy

Explores the need for ESG Performance Benchmarking, its impact on business strategy, and a proposed framework for ESG benchmarking for companies.

My first brush with the sustainability reporting disclosures, the Global Reporting Initiative (GRI) framework, and a high-level strategic outlook towards the business strategy of sustainability came in early 2018. I worked with a team of extraordinary people of a very successful industry-leading company to publish a sustainability report aligning with the GRI standards. Over the years, my work with various stakeholders primarily from the business strategy and corporate development perspective allowed me to understand some nuances of the seemingly naive narrative of “sustainability is a core principle of our business.” I unpack some of those learnings through this edition of the newsletter, trying to approach the strategic outlook of sustainable businesses through first principles. I may cross over into a bit of game theory nash-equilibrium perspective which are just added to satisfy my own intellectual kick.

Decoding the “ESG Performance” Whale

ESG performance has been a hotbed of innovation, company disclosures, and alternative financing from an investor perspective, emerging well into the limelight in the last two years. Beginning in 2019, there was a sharp increase in ESG performance-related disclosures in the global markets as well as in Indian markets.

According to the “Reporting Matters” study of World Business Council for Sustainable Development (WBCSD), of the 158 sustainability reports published by Indian and global companies, 84% of the companies declared their ESG performance through sustainability reports using the GRI (Global Reporting Initiative) standards in 2020, moving from a meagre 13% in 2017.

Furthermore, the top 1000 companies in India voluntarily disclose their ESG performance through the Business Responsible Report (BRR), mandated by SEBI in their public disclosures to the investors. A recent circular by SEBI on 10th May 2021 introduces a new format of the Business Responsibility and Sustainability Report(“BRSR”).

The BRSR is a notable departure from the existing Business Responsibility Report(“BRR”) and a significant step towards bringing sustainability reporting at par with financial reporting. The reporting requirements were finalized based on feedback received from public consultation and extensive deliberations with stakeholders including corporates, institutional investors. Further, a benchmarking exercise with internationally accepted disclosure frameworks was also undertaken.

The Carbon Disclosure Project (CDP) has Full Greenhouse Gas (GHG) Emissions Dataset. It's one of the most popular features of its investor membership package as it includes both self-reported and estimated Scope 1, 2 and 3 emissions data for over 5,000 companies. This is an essential tool for carbon footprint analysis and includes details of data quality and source information.

Need for ESG Disclosures by companies for Investors

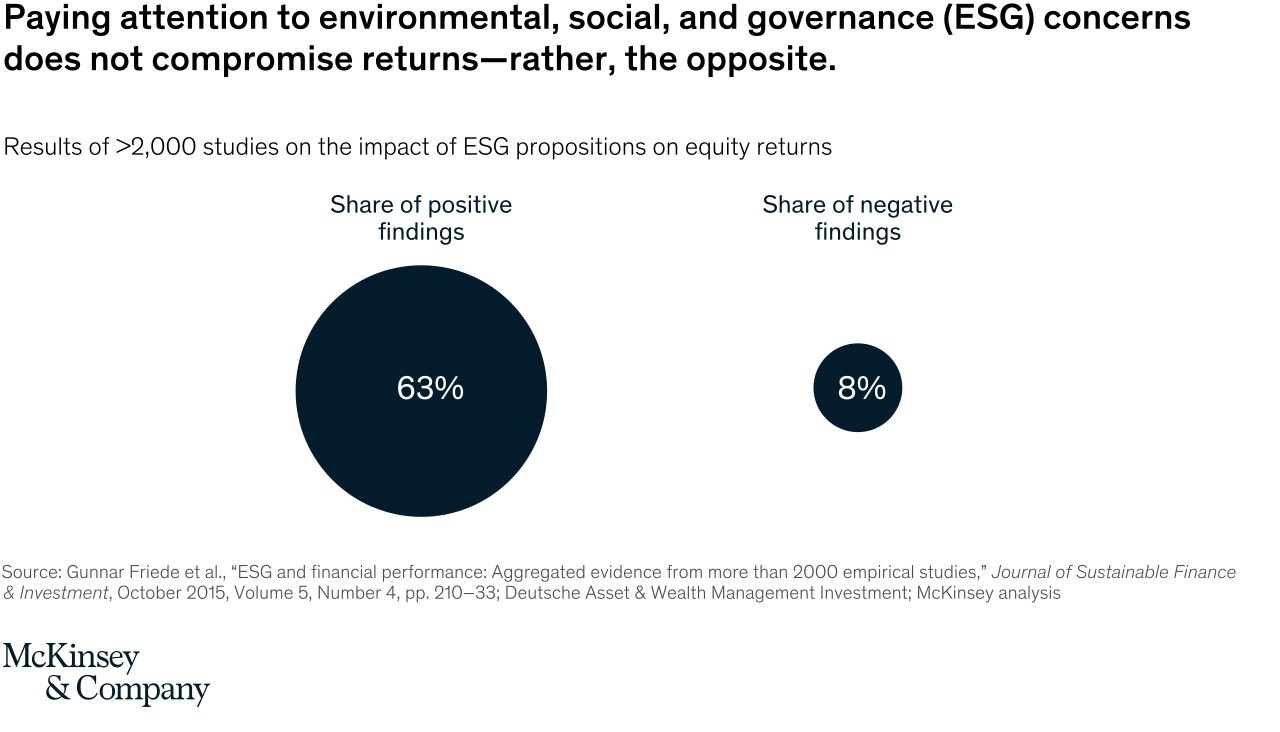

In principle, all investors face similar challenges and consider similar issues, such as analyses of risk, including country, industry and policy risk, together with the assessment of competitive position, management quality, cash flow, financial returns and balance sheet strength. Most responsible investors use some form of screening/ filter/weighting/tilting strategy to avoid or mitigate specific ESG risks, such as reputational damage. However, some are now integrating ESG into their analyses, in order to identify positive impacts from contributions to the SDGs and to understand the effect a company has on the environment, communities, development, etc.

This provides a sense of the long-term strategic competitive advantage for a company, as it clearly outlines the risks towards the environment, its own internal and external stakeholders, as well as reputational risks based on governance. Companies that disclose ESG risks and performance metrics ensure that the top management is aware of investing company resources in mitigating these risks, which enable long-term business value for the company. This helps them in acquiring better terms with their suppliers, higher customer and employee retention, better engagement with the external board, and a strong base of investors who remain with the company ensuring its success in the long term. Each of these aforementioned factors helps optimise cost and increase revenue drivers for the company in the long term.

Companies looking to access capital via IPOs need to be particularly sensitive to the fact that environmental, social and governance (ESG) matters have become an integral part of every company’s equity story. They will increasingly be expected to provide information about the role ESG plays in their strategy, with a focus on the material value drivers and risks that can impact their financial position and performance. And with the momentum around establishing global standards on non-financial reporting, the focus on companies providing ESG information is gathering pace. Transparency about the company’s material ESG issues, such as its efforts to decarbonise its operations and supply chain, backed by reliable data, is therefore becoming more and more necessary for making that critical first impression.

My Proposed Framework for ESG Performance Analysis

Thoroughly unhappy with the evaluation framework proposed by CRISIL in its recent report, I thought this is the best time to revisit my proposed framework for ESG performance benchmarking. I was able to blend a couple of major national and international standards of sustainability reporting and ESG standards adopted by the top companies across the world. This includes the GRI reporting standards (I helped write one of the sustainability reports for a top telecom company in India using the GRI reporting standards, 2018-19), MSCI ESG Metrics, and the SEBI BRR. It also included the recently introduced voluntary disclosures framework and format by SEBI for its Business Responsibility and Sustainability Reporting disclosure.

Some of the key focus areas are enumerated below:

Performance on Environment parameters included those like

Materials

Water

Waste and Effluents (Solid Waste plus Effluent Waste)

Energy

Emissions

Supplier Environment Assessment

Performance on Social parameters included those like

Employees and Workers

Diversity and Inclusion

Occupational Health and Safety

Employee Training

Communities - including investments in corporate social responsibility and responsible social projects

Consumers protection

Customer data integrity, security, and privacy

Performance on Governance parameters included those like

Investor disclosures

Pending litigation

Anti-trust and Anti-Competitive Behaviour

Bribery and Corruption Controversies

Business Ethics Controversies

Taxes and Subsidies Controversies

Foreign Market Revenue Greater Than 20%

Business Strategy for ESG Performance

My experience with the Aditya Birla Group has taught me to consider ESG performance from a business risk assessment standpoint, as well as a play on the critical long-term sustained competitive advantage of companies.

To increase ESG performance, businesses will have to spend a lot of capital which otherwise would be padding their bottom line and increasing their stock prices. However, the gamble is to invest early in technologies, institutions, people, and structures to outlast their competitors, having the most strategic competitive advantage. This expenditure of capital will ensure business longevity, favour from the governing compliance and legal system, and both a cost differentiation and a value differentiation strategy for competitive advantage.

Investing in employee training and initiatives with diversity and inclusion will build employee retention, and increase productivity levels. Occupational Health and Safety will ensure the longevity of business sites and continuous improvement in the efficiency of business operations. Investments in communities will enhance the company’s shared value and social license to operate, and garner goodwill from the community in the locations where the business sites are located.

A business is not a standalone entity. It is part of a chain that converts raw material into final products and services for consumers. In such chains, there is usually a powerful brand at the head of the chain that shapes the entire supply chain. Firms in such nodal positions provide the necessary leadership, drive relevant mandates, and foster innovation across the entire chain. We often find ourselves in such a position in our supply chain with the opportunity to develop a sustainable value chain that will more and more, by definition, only contain sustainable businesses. We expect many businesses to fail as the planet deteriorates and legislation toughens and if that means our supply chain fails then we face additional risks.

Until recently, companies did not prefer divulging information about their operations, fearing loss of competitive advantage. In some business areas, for example, the upstream supply chain, data availability was particularly poor. However, increasingly it has become apparent that supply chain transparency is critical to drive improvement and create the ability to react with agility as issues arise. In addition, companies are under increasing pressure from various stakeholders to report substantial information, particularly risks associated with climate change and the Board’s strategy for their business, and there will be a growing reputational, and potentially financial, cost of failing these demands.

— The Aditya Birla Group

Conclusion

ESG performance benchmarking is the first step for any company to consider a holistic risk assessment and risk management from corporate development and strategic perspective. With CRISIL putting out its benchmarking report this week, I believe this is just the beginning for companies to consider taking concrete steps to engage in this ESG performance benchmarking exercise, and create risk mitigation plans for all the pertinent ESG risks I managed to highlight in the aforementioned proposed framework. I am happy to engage with industry leaders in helping them with this exercise in greater detail. You can reach me at aashir.sutar@gmail.com to discuss further.

Reading This Week - Loonshots, by Safi Bahcall

Loonshots reveals a surprising new way of thinking about the mysteries of group behaviour that challenges everything we thought we knew about nurturing radical breakthroughs.

Bahcall, a physicist and entrepreneur, shows why teams, companies, or any group with a mission will suddenly change from embracing new ideas to rejecting them, just as flowing water will suddenly change into brittle ice. Mountains of print have been written about culture. Loonshots identifies the small shifts in the structure that control this transition, the same way that temperature controls the change from water to ice.

Using examples that range from the spread of fires in forests to the hunt for terrorists online, and stories of thieves and geniuses and kings, Bahcall shows how a new kind of science can help us become the initiators, rather than the victims, of innovative surprise.

Over the past decade, researchers have been applying the tools and techniques of this new science—the science of phase transitions—to understand how birds flock, fish swim, brains work, people vote, diseases erupt, and ecosystems collapse. Loonshots is the first to apply these tools to the spread of breakthrough ideas. Bahcall distils these insights into practical lessons creatives, entrepreneurs, and visionaries can use to change our world.

Along the way, readers will learn how chickens saved millions of lives, what James Bond and Lipitor have in common, what the movie Imitation Game got wrong about WWII, and what really killed Pan Am, Polaroid, and the Qing Dynasty.