#9 Economics and a Framework for the Design of Loyalty Programmes of Businesses

Explores enabling factors, underlying economics, rules for rewards design, and competitive strategy for developing an effective loyalty framework in increasing CLV and sustained competitive advantage.

In the past week, I encountered the following:

A famous D2C brand in the food space talking about its failures in a Clubhouse session on implementing a subscription-based loyalty programme as a potential sales channel.

Payment of a pizza delivery through the CRED app enabled a discount of Rs 80 on the bill, by deducting 3000 CRED coins from my kitty. (More in the subsequent points)

The National Restaurant Association of India filing a grievance with the Competition Commission of India against platform aggregators - Swiggy and Zomato. The list had some interesting arguments provided:

The alleged practices highlighted by NRAI include bundling of services, data masking and exorbitant commission charged; price parity agreements; deep discounting: (NRAI cites forcing of restaurant partners to give discounts to maintain appropriate listing); exclusivity of listed restaurants; violation of platform neutrality, vertical integration and lack of transparency on the platform.

The “Price Parity Agreements” bit was very interesting. In simple terms, an “Price Parity Agreement” is an agreement between two vertical parties. The upward online business supplies its goods or services to the downward platform website at the best available price.

This commitment prohibits the supplier from offering better benefits or discounts on any competing platform. In return, the platform employing its own resources markets the goods or services such that the consumer base expands while simultaneously promoting itself as an attractive sales channel.

For instance, hotels pay a fixed percentage of revenue generated from the booking through the platform website as a commission fee when the customer books from that particular channel. A huge risk for this platform is ‘free-rider’ situation wherein, although the customer learns about the hotel room while browsing the platform, he books it through the hotel’s own website which advertises a lower tariff.

A Whatsapp chat with the question: “what is each cred coin worth? In paise and Rupees- if one was willing to spend rs 100 - how many cred coins would a person desire for it to make commercial sense?”.

Some of the responses to the aforementioned question included

There is no fixed value as of today. On travel the sometimes the value is 1 coin= 10 to 100 rs (comparing the discounted value to coins)

On store purchases, the value is 1 coin= .01 to .1 rs (Again, discounting on using cred coins).

Jackpot and other offers are just random luck so no fixed value.CRED does not explicitly communicate the values as of now. Travel offers are quite decent for most people who don't search much outside MMT (MakeMyTrip) and standard websites, but websites like luxury escapes provide very competitive offers for free.

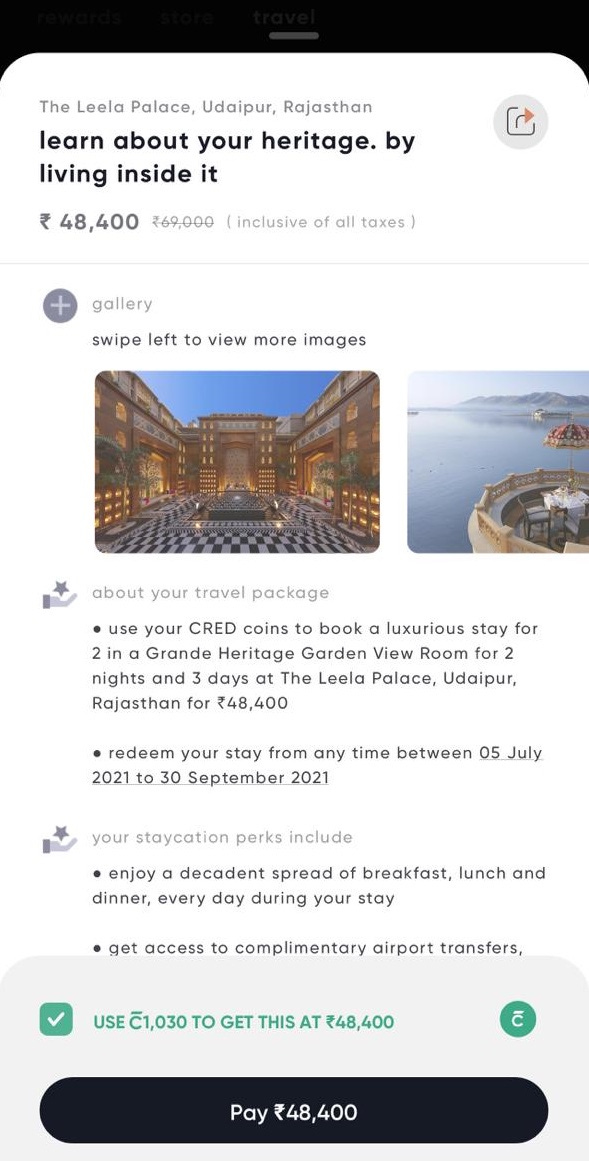

Some deals offer discounts up to 18k in exchange for 1800 cred coins as well. Leela palace deal in Bangalore (for that day) is an example.

CRED offered 21000rs discount in exchange for 1030 cred coins, bringing the bill value to Rs 48400, with the MMT price being RS 58000 for the same.

These aforementioned conversations indicated that the successful implementation of customer-loyalty based programmes are complex, and require a thoughtful and meticulous data-backed approach and strategic thinking. So much so that the famous Kellogg School of Management has a specialised 6-8 week programme build on exactly this problem.

As a result, I took up the challenge of thinking about how best to go about decoding the possible enablers of designing such a complex system, and what are the best practices that companies can use in this regard. This post takes a stab at the economics and design of customer loyalty programmes from a first-principles approach, and analyses some underlying governing dynamics of the system that enables the success of the programmes.

Customer Loyalty Programme - Definition and Types

In business, simple loyalty programs can strongly increase customer retention. Loyalty programs are one of the most popular marketing strategies developed by firms across a broad range of industries. In the world of customer loyalty programs, building a reward system that stands out is a major endeavour for any company, and it can be a game-changing opportunity if created with care and precision. From airlines offering frequent-flier deals to telecommunications companies lowering their fees to get more volume, organizations are spending millions of dollars developing and implementing rewards programs.

I would probably classify loyalty programmes into two major categories: monetary-based rewards and special treatment-based rewards.

Special treatment-based rewards design

Loyalty programs with special treatment rewards are designed mainly to provide comfort and peace of mind to loyal customers. Customers develop feelings of reduced anxiety, increased trust and confidence in the firm.

For example, loyalty programs of a restaurant that provides certain strategic tables only for its selected customers will provide the selected customers with feelings of assurance and reduced anxiety that they surely will get a table anytime they patronize the restaurant, a benefit that could not be obtained by other, non-selected customers.

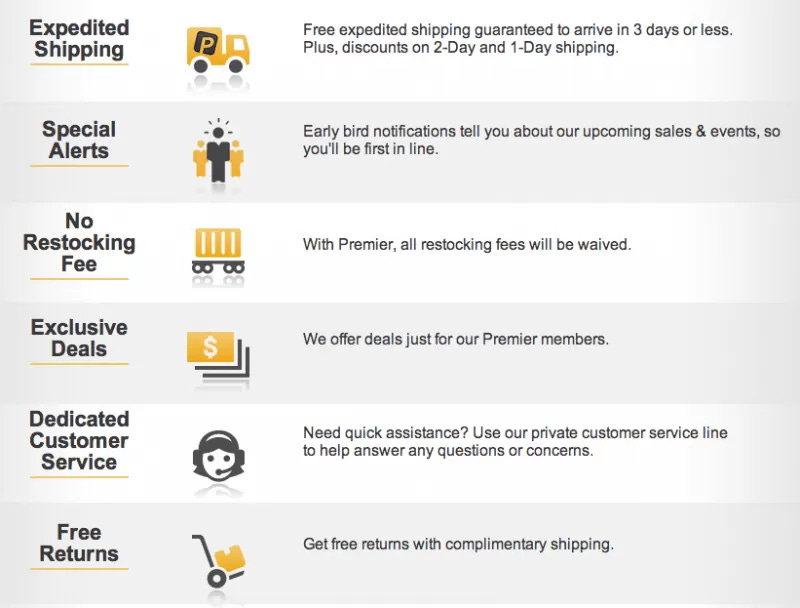

Special treatment rewards, to a certain extent, are analogous to hedonic benefits (related to pleasant sensations or user experience). They both refer to aesthetics, experiential and enjoyment-related benefits of offerings. Special treatment rewards trigger promotion emotions of cheerfulness and excitement in customers’ minds. In the origins of Amazon Prime lies one of the most successful examples of a special treatment based rewards programme.

Monetary-based rewards design

Loyalty program design that contains various types of monetary-based rewards are mainly aimed at providing an economic advantage to selected numbers of the firm’s customers. These customers can easily calculate their better “profit and loss statement”.

The rewards could be in the forms of real cash, bonus points, vouchers and so on, but despite the various forms, customers are usually able to perform “conversion “ of the value of the rewards into the equivalent cash value. Monetary rewards are, to a certain extent, analogous to utilitarian benefits. They both refer to functional, instrumental and practical benefits of offerings.

In practice, monetary reward-type loyalty programs are at risk of being perceived as similar to promotion programs. A lot of management science research suggests that Companies must carefully design loyalty programs in such a way that they do not give instant rewards to any customer. Rewards must be given only to those customers who are potentially loyal (that is if the loyalty programs have not yet been implemented) and loyalty programs must be committed to nurturing long-term successful relational exchanges, instead of maximizing short-term sales for the firm.

Cashbacks by Payment Apps like PayTM, Google Pay, etc as well as CRED Coins are excellent examples of Monetary-based rewards design.

Enablers of Customer Loyalty Programmes

Most management science literature on customer loyalty programmes emphasises on

CAC (Customer Acquisition Cost): The need to reduce the customer acquisition cost through these programmes.

Lifetime Value of Customer: Loyalty programmes contribute to higher lifetime value from customers, which simply put is a measure of the future worth (in terms of cashflows or margins) of a customer to the firm.

However, there are other factors that affect the design and development of these customer loyalty programmes, some of which are enumerated below:

Switching Costs: Especially with monetary-based rewards, the cost to the customer for switching is extremely low. This has to also be accounted for while designing the loyalty system.

Competition: It is important to adequately calculate the effect of competition on loyalty programmes, especially with monetary-based rewards. This is especially true due to things like the “Price Parity Agreements” mentioned in the earlier sections, along with low switching costs. More often than not, we see nash-equilibriums set between multiple players on either sides of a platform delicately balanced on cost-benefits and slender profit margins.

Components of Behavioural Economics: This is especially true with special treatment-based rewards, with components such as “in-the-moment” bias (availability instead of calculations), priming (subtle conditioning of the decision making process through cues and user experience), and loss aversion to benefits (losing a great deal bundled with making it readily available that prompts the user to not think too deeply about it).

Contractual and non-contractual business models: In general, the relationship between a customer and a firm can be classified into two modes: contractual and non-contractual. The main difference between the two modes involves whether the relationship is governed by a legal contract or membership inclusion, in the contractual instance, or neither in the non-contractual instance. Subscription-based business models are effective in this case than the others. The difference between the two modes of relationship can also be looked at from the point of view of switching costs.

Framework for Loyalty Programme Design

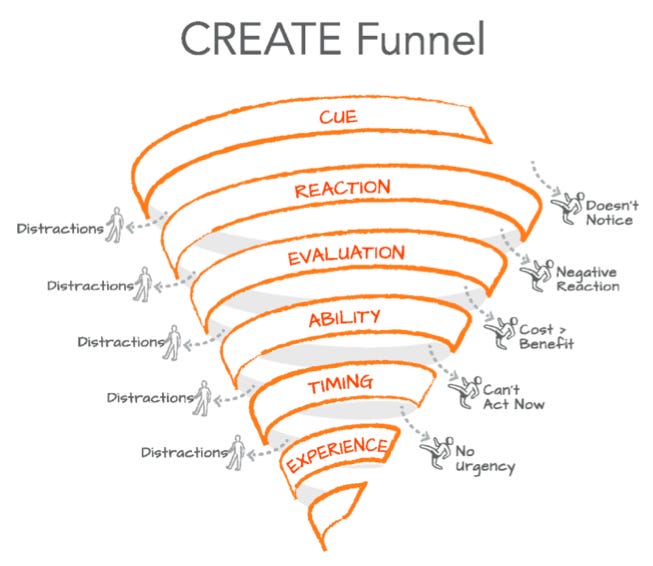

To build a worthy loyalty programme, I believe some of the following steps can be explored by a company:

Understanding the customer base: All customers are not created equal. Though the most focussed part of the loyalty programme is the anchor for “customer retention”, its impact varies on a lot of factors.

It is important to understand which of the customers bring in the maximum value to the business (say maximum revenues, or contribution to profit margins in case of businesses with multiple SKUs), as well as a deeper understanding of the offsets between value, switching costs, and contracts.

You will often observe a nash equilibrium point that balances the value, the switching costs, and the contracts in some of the successful loyalty programmes, like that of JetPrivilege or Amazon Prime.

A thorough analysis of the cash flows generated by the customers will help classify them into discrete buckets which can be targeted through a thorough strategy for loyalty programmes.

Defining the long-term perspective of the programme: This is one of the most undervalued parts of designing a loyalty programme for a business. It is always important to determine the overall long-term outlook of what the programme intends to achieve, what type of customers are its intended target, what is the offset between loyalty programmes used for customer acquisitions vs customer retention, and the impact on the brand equity of the business.

Targeting - Offers must target attractive customers: Unless you are Biryani, you cannot make everyone happy. It is critical then to understand what part of the portfolio of customers do you wish to target with the loyalty programme enabling them to retain the product/service, and what part of the portfolio of customers do you wish to acquire from the open market by promoting a value proposition of a loyalty programme which is enticing enough for those customers to switch from your competition to your company. A major enabling factor will be the contractual vs non-contractual business model. In the case of contractual business models, it is cost-effective to focus on customer acquisition as well as customer retention. In the case of non-contractual business models, it is best if we stick to customer retention based loyalty programmes.

The Rules of Rewards: Once we complete point 1 through to point 3, we engage in the exercise of designing the rules of the rewards. At this stage, we determine which type of rewards programme do we choose to implement - a monetary-based rewards programme, a special treatment-based rewards programme, or a blend of both. We also determine the size and convexity (price vs yield) of the rewards. This should also take into account the sustained profitability and layout of the business competition. We also should take into account the time period for these loyalty programmes, calculating the sensitivity analysis of frequent transactions vs infrequent transactions and their impact on the rewards. (Sensitivity analysis is a financial model that determines how the target variables are affected based on changes in other variables known as input variables. This model is also referred to as what-if or simulation analysis. It is a way to predict the outcome of a decision given a certain range of variables.)

Value created must exceed the cost of value delivered: Though obvious, this rule becomes an issue when the long-term outlook for the loyalty programmes is not outlined. A delicate balance needs to be aligned on retaining customers through these loyalty rewards programmes while offsetting the benefits through the costs incurred by running these loyalty programmes. The difficulty of such an arrangement increases multi-fold when the retained customers are either infrequent in their transactions, or the value of the transactions is low.

Customer behaviour should drive value sharing: In order for a rewards program to be a profit centre instead of a cost centre, the payout must be inextricably linked to desired behaviours.

Referral Programme: One of the most underutilised parts of loyalty programmes is that of customer referrals. In continuation of point 6 in ensuring that the customers drive value sharing, it is critical to enable a part of customer referral as a part of doing both customer retention as well as customer acquisition. It builds not just a strong sense of community, but also allows customers to share the value of the business that creates long-term engagement.

The Strategy Behind the Program: A rewards program is a competitive strategy and, as such, it must meet certain criteria. VRIO framework is ideal in such a situation. Does the program align with company capabilities? Will customers value the program? Can competitors offer a more desirable alternative? Would partnering make the program more competitive? Any rewards program that does not address such criteria is unlikely to succeed.

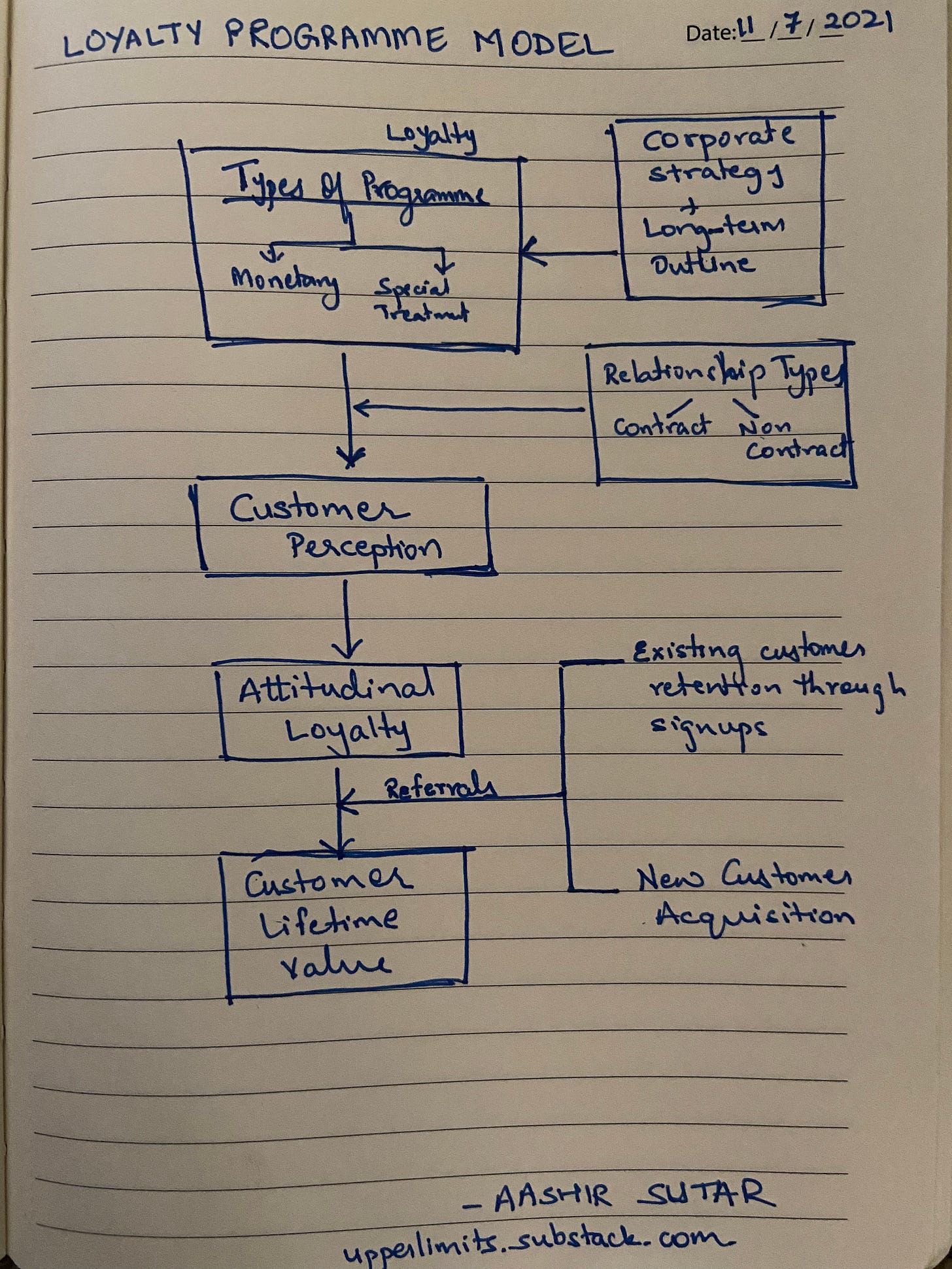

Mockup of the Loyalty Programme Model

The following diagram encapsulates (or tries to) the aforementioned 8 points that capture the framework of customer loyalty programmes and builds a model around it.

The Way Forward

With a stronger focus on anti-competitive behaviour, the consolidations in the startup ecosystem, the rise of D2C companies, as well as vertical integration of matured startups, we will encounter more such loyalty programmes in the years to come. I strongly believe these loyalty programmes provide enormous value to the customers, and can be extraordinary drives of strategic competitive advantage when well designed and implemented. With Omni-channel retail and the evolution of business models, it will be critical for companies to build their competencies in this domain. One can only hope some successful models in India trickle down to other startups in emerging economies as an example of the future of eCommerce and platform-based economies.