#24 Expanded Fund Trails, Related Party Transactions, and Governance Implications - Gensol Engineering Limited (Series Part III)

An Analysis of Corporate Governance Failures and Alleged Fund Diversion by Gensol Engineering, and its promoters Anmol Singh Jaggi and Puneet Singh Jaggi.

This edition is a continuation of the Gensol Engineering Series. The first part of the series can be read here:

Part I: https://open.substack.com/pub/upperlimits/p/22-gensol-engineering-limited-genesis

The second part, covering the fund misappropriation, is covered here:

Part II: https://open.substack.com/pub/upperlimits/p/23-anatomy-of-alleged-fund-misappropriation

Building upon the alleged diversion of EV loan funds, this segment examines broader patterns of fund movement involving Gensol and its connected entities, particularly Wellray Solar Industries Private Limited. It explores how funds sourced from Gensol, including those potentially diverted from loans, were allegedly funneled through Wellray to benefit promoters personally, finance promoter investments in Gensol itself, and fund trading activities in Gensol's shares. Furthermore, this section scrutinizes the company's disclosures, the implications of promoter share pledging, and the overall breakdown of corporate governance highlighted by SEBI, leading to significant interim regulatory actions.

Overview

The investigation reveals Wellray Solar Industries Pvt. Ltd., an entity with historical ties to Gensol's promoters and currently owned by a former employee, as another key node in the alleged fund diversion network [Paras 58, 59]. Although significant sales and purchases were booked between Gensol and Wellray, the actual flow of funds between them far exceeded these recorded commercial transactions, suggesting Wellray served purposes beyond genuine business dealings [Paras 60, 63].

A substantial portion of the funds Wellray received from Gensol (Rs. 424.14 Cr between FY23-FY24) was allegedly transferred onwards to numerous related parties, including direct payments totaling Rs. 39.31 Cr to promoters Anmol Singh Jaggi and Puneet Singh Jaggi [Paras 65, 66].

These personal funds were reportedly used for further transfers to related entities, family members, and personal expenses [Paras 68, 69]. Funds routed through Wellray were also allegedly used to finance a promoter entity's subscription to Gensol's preferential share issue in 2022, effectively suggesting the company funded its own promoter's investment [Paras 70-75].

Additionally, Wellray extensively traded in Gensol's shares, largely using funds sourced from Gensol and its related parties, raising concerns about potential violations of the Companies Act regarding financial assistance for share purchase and possible market manipulation [Paras 76-79]. SEBI also flagged potentially misleading disclosures by Gensol regarding EV pre-orders and a subsidiary valuation, further eroding investor confidence [Paras 80-84].

The significant pledging of promoter shares adds another layer of risk for public shareholders [Paras 85, 86].

Executive Summary

SEBI's probe uncovered that Wellray Solar, closely linked to Gensol's promoters, received vastly more funds from Gensol (Rs. 424 Cr) than justified by recorded business transactions (Rs. 138 Cr in purchases over two years). Of the received amount, Wellray transferred Rs. 246 Cr to Gensol-related entities, including Rs. 39.31 Cr directly to promoters Anmol and Puneet Jaggi, which were then allegedly used for personal expenses, family transfers, and investments in other promoter entities.

Furthermore, a complex transaction trail indicates Gensol funds, routed via Wellray, enabled a promoter entity (Gensol Ventures) to subscribe to Gensol's preferential share issue in 2022. Wellray also emerged as a major trader in Gensol's stock (trading value > Rs. 338 Cr), primarily funded (Rs. 101 Cr traced) by Gensol and its associates, potentially violating Section 67 of the Companies Act.

Misleading corporate announcements about EV orders (found to be non-binding MOUs with no manufacturing apparent) and subsidiary valuations further damaged credibility. With promoter shareholding already diluted and heavily pledged (over 75.74 Lakh shares pledged to IREDA alone), the risk of further stake reduction and loss of promoter control loomed large.

These findings culminated in SEBI concluding a "complete breakdown of internal controls and corporate governance," leading to interim directions restraining promoters, halting a proposed stock split, and mandating a forensic audit.

Analysis

Wellray Solar: A Conduit for Wider Diversion?

Wellray Solar Industries Private Limited emerges as a significant entity in SEBI's investigation beyond the initial EV loan fund trails. Its connection to Gensol is multifaceted:

Promoter History: Anmol Singh Jaggi and Puneet Singh Jaggi were directors in Wellray until April 15, 2020. Prior to FY 2019-20, Wellray was entirely owned by Puneet Singh Jaggi and Gensol Ventures Private Limited (a Gensol promoter entity) [Para 58].

Current Ownership: Presently, 99% of Wellray is held by Lalit Solanki, identified as a former Regulatory Affairs Manager at the Gensol Group until December 2018 (based on LinkedIn information) [Para 59]. This ownership by a former employee maintains a strong connection, raising questions about Wellray's operational independence from Gensol's promoters.

Business Dependence: Wellray's financials show a heavy reliance on Gensol. In FY 2022-23, sales to Gensol constituted 91% of Wellray's total sales [Para 62]. Despite rising revenues, Wellray consistently reported losses after tax from FY21 to FY23 [Para 61]. This dependence makes it susceptible to influence from Gensol.

Discrepant Fund Flows: While Gensol booked purchases/expenses from Wellray totaling Rs. 66.98 Cr (FY23) and Rs. 71.55 Cr (FY24) [Para 60], the actual fund transfers from Gensol to Wellray were much higher: Rs. 215.89 Cr (FY23) and Rs. 208.25 Cr (FY24), totaling Rs. 424.14 Cr. Similarly, funds received back by Gensol from Wellray (Rs. 310.19 Cr total) also didn't align perfectly with recorded sales [Para 63]. This significant gap between recorded transactions and actual cash flow strongly suggests Wellray was used for purposes beyond genuine commercial dealings, likely facilitating fund movement as alleged by SEBI.

Funneling Funds to Promoters and Related Parties via Wellray

SEBI's analysis of Wellray's bank statements (ICICI A/c No. 058605002357) revealed that out of the Rs. 424.14 Cr received from Gensol (FY23-FY24), Rs. 382.84 Cr was transferred onwards. The major recipients were categorized as:

Related/Linked Parties of Gensol: Rs. 246.07 Crore

Sharekhan Limited (Stock Broker): Rs. 40.70 Crore

Public Shareholders of Gensol: Rs. 5.17 Crore

Others: Rs. 90.90 Crore [Para 65]

The transfers to related parties are particularly concerning. Wellray transferred significant amounts to entities like Matrix Gas (Rs. 63.9 Cr), GoSolar Ventures (Rs. 68 Cr), Gensol Consultants (Rs. 21.6 Cr), Capbridge (Rs. 11 Cr), and Prescinto (Rs. 9.26 Cr) [Para 66].

Most critically, Wellray directly transferred Rs. 25.76 Cr to Anmol Singh Jaggi and Rs. 13.55 Cr to Puneet Singh Jaggi (total Rs. 39.31 Cr) during FY23 and FY24 [Para 66]. SEBI traced the further use of these funds from the promoters' personal bank accounts:

Anmol Singh Jaggi (received Rs. 25.76 Cr from Wellray):

Transferred Rs. 10.64 Cr to Gensol Ventures (promoter entity).

Transferred Rs. 6.20 Cr to Jasminder Kaur (mother) and Rs. 2.98 Cr to Mugdha Kaur Jaggi (spouse).

Used Rs. 1.86 Cr for foreign currency (AED) purchase.

Invested Rs. 1.35 Cr in Batx Energies and Rs. 50 Lakh in Third Unicorn (where he holds shares).

Spent funds on high-end goods/services (TaylorMade golf set, Titan, DLF Homes maintenance, travel, credit cards) and transferred funds to company personnel (former CFO, ED) [Para 68].

Puneet Singh Jaggi (received Rs. 13.55 Cr from Wellray):

Transferred Rs. 10.03 Cr to Gensol Ventures (promoter entity).

Transferred Rs. 1.13 Cr to Shalmali Kaur Jaggi (spouse) and Rs. 87.5 Lakh to Jasminder Kaur (mother).

Used Rs. 66.3 Lakh for foreign currency (AED) purchase.

Spent funds on personal expenses (Amex cards, lease registration) and transferred funds to company personnel (ED) [Para 69].

This detailed tracing provides prima facie evidence that funds originating from the listed entity (Gensol) were routed through a connected entity (Wellray) directly into the personal accounts of the promoters and then used for personal expenses, family transfers, and investments in other private promoter ventures. This constitutes a clear alleged diversion and potential siphoning of funds belonging to the listed company and its public shareholders. The sheer scale of these direct transfers raises severe questions about the internal controls and oversight within Gensol that allowed such outflows via Wellray.

Financing Promoter's Preferential Allotment

In September 2022, Gensol undertook a preferential issue of equity shares at Rs. 1,036.25 per share [Para 70]. Under the promoter group category, Gensol Ventures Private Limited invested Rs. 10.09 Crore, subscribing to 97,445 shares on September 26, 2022 [Paras 70, 71].

SEBI traced the source of these funds. On the same day (Sep 26, 2022), Gensol Ventures received Rs. 10.07 Crore from Anmol Singh Jaggi and Puneet Singh Jaggi [Para 72]. These promoters, in turn, had received Rs. 5 Crore each from Wellray just before making the transfer to Gensol Ventures [Para 72]. Completing the circle, Wellray itself received Rs. 10 Crore from Gensol Engineering Limited on the same day, just before transferring the funds to the promoters [Para 73].

This sequence (Gensol -> Wellray -> Promoters -> Gensol Ventures -> Gensol Preferential Issue Account) strongly suggests that Gensol effectively funded its own promoter's subscription to its preferential allotment through a series of layered transactions designed to obscure the origin of the funds [Para 74, 75]. This is a serious allegation, potentially violating Section 67 of the Companies Act, 2013, which prohibits a company from giving financial assistance, directly or indirectly, for the purchase of its own shares.

Funding Trading in Gensol Shares via Wellray

SEBI's analysis of Wellray's trading activity between April 2022 and December 2024 revealed that it predominantly traded in the shares of Gensol Engineering Limited. The total buy value in Gensol shares was Rs. 160.51 Crore, and the sell value was Rs. 178.44 Crore, accounting for 99% of Wellray's total trading value during this period [Paras 76, 77]. This indicates Wellray was a very active participant in the market for Gensol shares.

Crucially, SEBI traced the source of funds used by Wellray for this trading activity. Out of Rs. 137.57 Crore cumulatively transferred by Wellray to its broker Sharekhan until March 2024, Rs. 101.35 Crore originated from Gensol Engineering itself (Rs. 40.7 Cr) and various other related parties like Matrix Gas (Rs. 46 Cr), Go-solar Ventures (Rs. 5.65 Cr), Capbridge (Rs. 2.1 Cr), Gensol Consultants (Rs. 1.6 Cr), and even directly from the promoters [Para 78].

This finding implies that Gensol and its associated entities were potentially funding Wellray's trading activities in Gensol's own shares. As with the preferential allotment funding, this raises serious concerns under Section 67 of the Companies Act, 2013 (prohibition of financial assistance for purchase of own shares). Furthermore, such large-scale trading by a connected entity, funded by the company itself, could potentially be used to artificially influence the share price or trading volume, raising concerns about market manipulation under SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market) Regulations, 2003 [Para 87]. While Wellray apparently made gains (selling value > buy value) [Para 79], the source of funds and the potential market impact remain highly problematic.

Misleading Disclosures and Operational Reality

SEBI highlighted several instances where Gensol's public disclosures appeared misleading or lacked substantiation:

EV Pre-orders: A disclosure on January 28, 2025, claimed pre-orders for 30,000 newly launched EVs. Examination revealed these were merely non-binding Memorandums of Understanding (MOUs) with 9 entities for 29,000 vehicles, lacking crucial details like price or delivery schedules [Para 80]. Presenting MOUs as firm "pre-orders" significantly overstates the actual business secured and can mislead investors about future revenue potential.

Manufacturing Plant Status: An NSE site visit to Gensol's purported EV manufacturing plant in Chakan, Pune, on April 9, 2025, found "no manufacturing activity" and only 2-3 laborers present. Electricity bills for the past year were minimal, suggesting no significant operations [Paras 81, 82]. This contradicts the image of a company actively launching and taking orders for thousands of EVs and raises questions about the actual progress of its EV manufacturing venture.

Refex Deal: A January 16, 2025 disclosure announced a "strategic tie-up" with Refex Green Mobility to transfer 2,997 EVs and associated loans worth Rs. 315 Crore. However, this deal was withdrawn via a disclosure on March 28, 2025 [Para 83]. Announcing and then withdrawing such a significant deal raises questions about the initial certainty and due diligence behind the announcement.

US Subsidiary Valuation: A February 25, 2025 disclosure mentioned signing a non-binding term sheet for Rs. 350 Crore for the sale of its US subsidiary, Scorpius Trackers Inc. This subsidiary was incorporated only on July 22, 2024. Gensol failed to provide SEBI with any rationale or basis for this substantial valuation for a recently formed entity [Para 84]. Announcing such a high potential valuation without clear justification can unduly inflate market expectations.

These instances collectively suggest a pattern of potentially inflated or misleading communications to the market, aimed at portraying a more positive picture than reality warranted, especially regarding its nascent EV business. This falls short of the transparency and accuracy required under LODR regulations.

Promoter Share Pledge and Shareholder Risk

As of March 31, 2025, the promoters (Anmol Singh Jaggi, Puneet Singh Jaggi, and Gensol Ventures Pvt Ltd) held 35.125% of Gensol, amounting to 1,33,48,359 shares [Paras 7, 85]. IREDA informed SEBI that pledges had been created on 75.74 Lakh promoter shares (approximately 56.7% of their total holding) [Para 86]. Furthermore, recent pledge invocation data suggested lenders were invoking more shares in April 2025 [Para 86].

This high level of share pledging, coupled with the company's ongoing loan defaults [Para 20], creates significant risk. If lenders continue to invoke pledges due to non-payment of promoter or company debts secured by these shares, the promoter shareholding could drastically reduce, potentially becoming negligible [Para 86]. This loss of "skin in the game" could further destabilize the company and negatively impact minority shareholder confidence. The large public shareholding (nearly 65%) means any further value erosion due to promoter actions or forced selling by lenders would primarily harm institutional and retail investors.

Governance Breakdown and Regulatory Response

SEBI concluded that the findings indicated a "complete breakdown of internal controls and corporate governance norms" [Para 89]. The promoters allegedly treated the listed company's funds as their personal resource, routing money through related parties for personal benefit and unconnected expenses [Para 89]. This lack of financial discipline and disregard for governance norms created significant risks, not just for the EV leasing segment but also for the company's core EPC business, which relies on institutional trust and financial credibility [Para 90].

The ease with which funds flowed through layered transactions to multiple related entities pointed to weak internal controls and a culture where promoter discretion overrode established processes [Para 91]. Given the substantial dilution of promoter holding and the risk of further offloading onto potentially unaware investors, SEBI deemed immediate intervention necessary [Para 92]. The recently announced 1:10 stock split was also seen as potentially attracting more retail investors into a risky situation and was thus put on hold [Paras 93, 96(c)].

Consequently, SEBI issued strong interim directions [Para 96]:

Restraining Anmol Singh Jaggi and Puneet Singh Jaggi from acting as director or KMP in Gensol.

Restraining the company and the promoters from dealing in securities.

Halting the proposed stock split.

Ordering the appointment of a forensic auditor to conduct a detailed examination of Gensol and its related parties' books within six months.

These actions aim to protect investors, preserve market integrity, prevent further alleged fund diversion, and facilitate a thorough investigation into the full extent of the irregularities [Paras 94, 96, 97].

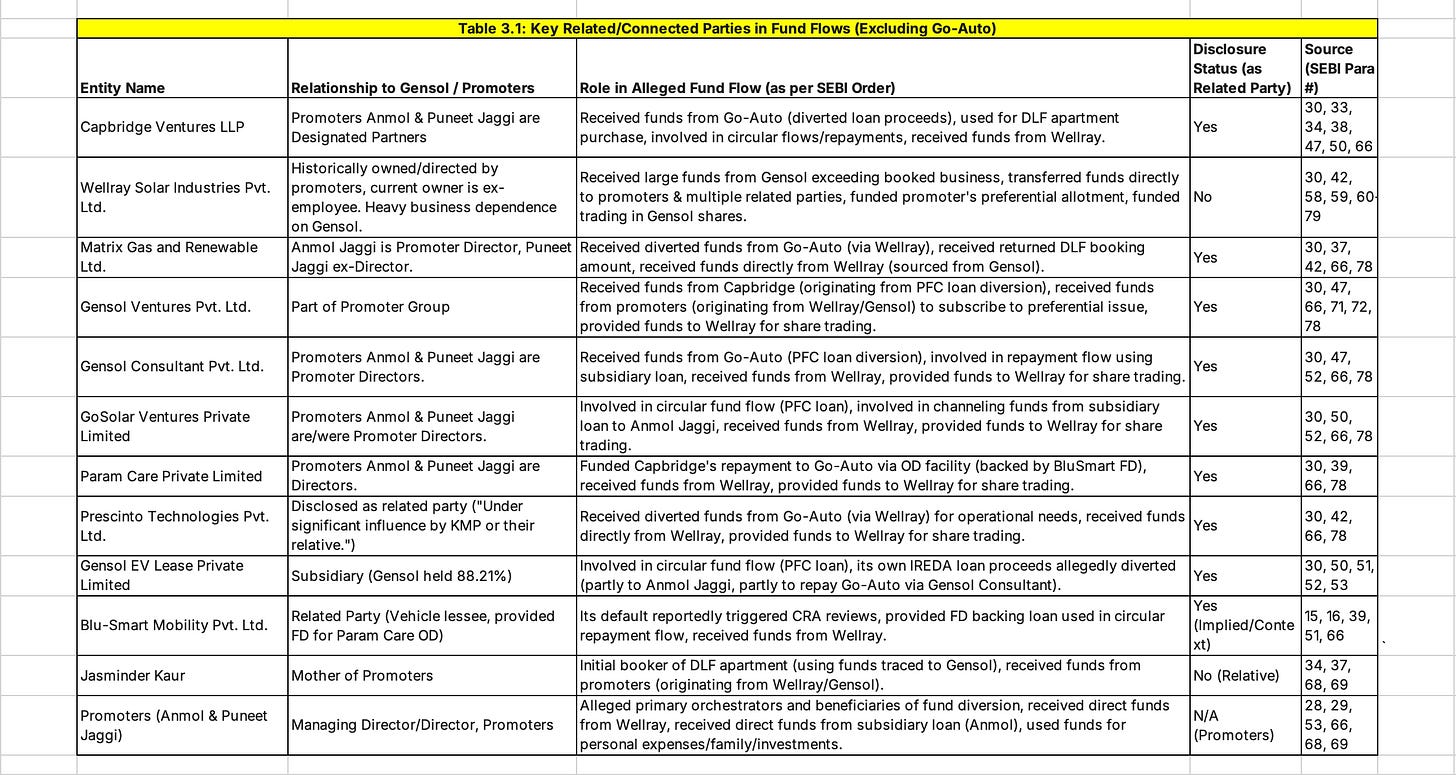

This intricate network of related and connected entities facilitated the complex movement of funds, making the transactions appear legitimate on the surface while allegedly enabling significant diversion and personal enrichment, highlighting severe failures in corporate governance.

Semi-final word

So, Gensol Engineering. They started with solar panels, a perfectly respectable business. Then, perhaps fueled by an excess of entrepreneurial zeal (or maybe just really good coffee), they decided to also build electric cars, lease electric cars (mostly to their other company, BluSmart ), make solar trackers , store battery energy , and contemplate the mysteries of green hydrogen. You know, synergies. This grand vision required capital, lots of it, conveniently provided by lenders like IREDA and PFC, who handed over nearly a thousand crores, largely earmarked for those shiny new EVs.

The plan, allegedly, hit a snag. Or rather, the money hit a detour. SEBI suggests a significant chunk of the EV cash, instead of buying EVs, went on a little adventure. It flowed to a car dealer, Go-Auto, which seemed more adept at flowing cash out than delivering cars , and through another related entity, Wellray/Ultravera , which apparently used Gensol's money to trade Gensol's stock. The alleged final destinations? A swanky DLF Camellias apartment , a TaylorMade golf set , funding the promoters' own investment back into Gensol , and various other personal pursuits.

When lenders and rating agencies noticed the loan payments weren't quite arriving on schedule, the response allegedly involved some creative paperwork – specifically, forged "Everything is Fine" letters. This strategy proved suboptimal. Ratings plunged to 'D' , the stock performed an impression of a falling anvil , promoter pledges were invoked with gusto , and SEBI arrived, barring the promoters and memorably describing the operation thus: "The promoters were running a listed public company as if it were a propriety firm... as if the company's funds were promoters' piggybank". Ouch.