#23 Anatomy of Alleged Fund Misappropriation: The EV Procurement Facade - Gensol Engineering Limited (Series Part II)

An Analysis of Corporate Governance Failures and Alleged Fund Diversion by Gensol Engineering, and its promoters Anmol Singh Jaggi and Puneet Singh Jaggi.

This edition is a continuation of the Gensol Engineering Series. The first part of the series can be read here:

Part I: https://open.substack.com/pub/upperlimits/p/22-gensol-engineering-limited-genesis

This segment delves into the core allegations leveled by SEBI concerning the misappropriation and diversion of funds by Gensol Engineering and its promoters, Anmol Singh Jaggi and Puneet Singh Jaggi. The focus is primarily on substantial term loans obtained from the Indian Renewable Energy Development Agency Ltd. (IREDA) and Power Finance Corporation (PFC), ostensibly for the procurement of a large fleet of Electric Vehicles (EVs). SEBI's prima facie findings suggest that a significant portion of these funds was not used for the stated purpose but was instead systematically rerouted through a complex web of transactions involving related parties, ultimately benefiting the promoters personally and funding unrelated activities.

Overview

The investigation highlights a major discrepancy between the funds sanctioned and supposedly deployed for EV procurement and the actual number and value of vehicles acquired. Gensol secured loans totaling Rs. 663.89 Crore from IREDA and PFC specifically for purchasing 6,400 EVs, with an additional 20% equity contribution expected, bringing the total planned deployment to nearly Rs. 830 Crore [Paras 24, 25, 27]. However, evidence indicates only 4,704 EVs worth Rs. 567.73 Crore were actually procured, leaving a substantial amount unaccounted for [Para 26]. Go-Auto Private Limited, the designated EV supplier, emerges as a pivotal entity, allegedly acting as a conduit for channeling funds away from their intended use [Para 28]. SEBI's analysis details intricate, layered transactions where funds flowed from Gensol to Go-Auto and were then immediately dispersed to various entities linked to the promoters or even back to Gensol itself, often involving circular movements [Paras 29, 44, 50]. A significant portion of these diverted funds was allegedly used for personal promoter expenses, including high-value real estate [Paras 29, 34]. These activities raise serious questions about the effectiveness of bank due diligence and monitoring processes [Paras 5, 19].

Executive Summary

SEBI's interim findings point towards a significant alleged misappropriation of funds related to EV procurement loans.

Out of a total expected deployment of approximately Rs. 829.86 Crore (Rs. 663.89 Cr loan + Rs. 165.97 Cr equity) meant for 6,400 EVs, only Rs. 567.73 Crore was spent on acquiring 4,704 EVs.

This leaves a gap of Rs. 262.13 Crore unaccounted for, despite the loans being disbursed over a year prior [Paras 26, 27].

Go-Auto Private Limited played a central role, receiving large sums from Gensol (Rs. 775 Cr total transferred vs. Rs. 567.73 Cr EV cost) and immediately transferring substantial portions (prima facie Rs. 96.69 Cr from one PFC loan alone) to promoter-linked entities like Capbridge Ventures LLP and Wellray Solar Industries Pvt. Ltd., or back to Gensol [Paras 28, 47, 54]. These funds were allegedly used for purposes entirely unrelated to EV purchase, including the acquisition of a luxury apartment by a promoter-controlled entity and other personal expenses of the promoters [Paras 34-37].

Complex layering and circular transactions involving multiple related parties appear to have been employed to obfuscate the fund trail [Paras 44, 50]. The apparent ease of these diversions suggests potential lapses in bank oversight and end-use verification.

Analysis

The EV Funding Discrepancy

Between FY 2021-22 and FY 2023-24, Gensol availed significant term loans from IREDA and PFC, totaling Rs. 977.75 Crore as per its annual reports [Para 24]. A substantial portion of this debt, specifically Rs. 663.89 Crore, was explicitly sanctioned to procure 6,400 Electric Vehicles [Para 25]. These vehicles were intended to be leased to BluSmart Mobility Private Limited, identified as a related party of Gensol.

Standard lending practice for such asset financing typically requires the borrower to contribute a margin. In this case, Gensol was expected to provide an additional 20% equity contribution towards the EV purchase [Para 27]. This brings the total anticipated capital deployment for the 6,400 EVs to approximately Rs. 829.86 Crore (Rs. 663.89 Cr loan + ~Rs. 165.97 Cr equity).

However, Gensol itself acknowledged, in a response dated February 14, 2025, that it had procured only 4,704 EVs as of that date [Para 26]. This number was corroborated by the stated supplier, Go-Auto Private Limited, which confirmed selling 4,704 EVs to Gensol for a total consideration of Rs. 567.73 Crore [Para 26].

Comparing the expected deployment (Rs. 829.86 Cr) with the actual expenditure on delivered vehicles (Rs. 567.73 Cr) reveals a significant shortfall of Rs. 262.13 Crore [Para 27]. This substantial amount remains unaccounted for, despite more than a year having passed since the last tranche of the relevant financing was availed [Para 27]. The sheer magnitude of this discrepancy, representing nearly a third of the total planned EV investment, strongly suggests that this was not merely a result of project delays or cost savings. Such a large gap points towards a potentially deliberate and systematic diversion of funds planned from the outset.

Utilizing a specific, verifiable asset purchase like EVs as the stated purpose for the loans might have been a strategic choice to facilitate easier access to funding compared to seeking general working capital loans, which often face stricter scrutiny regarding end-use. The immediacy with which funds were allegedly rerouted upon disbursement further supports the notion of premeditated diversion.

Go-Auto Private Limited: The Central Conduit

Go-Auto Private Limited was identified as the supplier from whom Gensol was procuring the EVs [Para 26]. Corporate records indicate Go Auto Private Limited (CIN: U34300DL2008PTC182562) was incorporated in August 2008 and is registered in Delhi, with Ajay Agarwal and Mukesh Agarwal as its directors. Its authorized capital is Rs. 30 Crore, with a paid-up capital of Rs. 2.9 Crore. The company's registered office is listed as being in Okhla Industrial Area, New Delhi. Its website (goauto.in) presents it as part of the "Tams Group," involved in diverse sectors including clean energy and e-commerce, claiming significant turnover and credit facilities. The website provides contact details including an address, phone number, and email.

Interestingly, SEBI's order notes that the Go-Auto website had no address or contact page, only an emailer [Para 5]. This conflicts with the information currently available on the website. This discrepancy could imply that the website was different or less informative at the time of SEBI's initial check, or that the check itself was incomplete. This point is relevant as it bears on the assessment of due diligence failures by lenders.

SEBI's investigation revealed that Go-Auto's role extended far beyond that of a simple vendor. Bank statement analysis showed that once funds were transferred from Gensol to Go-Auto, ostensibly for EV purchases, they were, in most instances, immediately transferred either back to Gensol itself or routed to other entities directly or indirectly related to Gensol's promoters, Anmol Singh Jaggi and Puneet Singh Jaggi [Para 28].

This pattern strongly suggests Go-Auto acted as a primary conduit in the alleged fund diversion scheme, rather than merely a supplier fulfilling orders. Its apparent active participation in immediately rerouting large sums implies potential complicity in the overall structure designed to move funds away from their intended purpose.

The financial relationship between Gensol and Go-Auto is further obscured by conflicting claims regarding outstanding dues. Ajay Agarwal, MD of Go-Auto, stated under oath to SEBI that Gensol owed Go-Auto around Rs. 50 Crore, implying no more EVs would be delivered [Para 55].

Conversely, Gensol claimed in an April 5, 2025 communication to SEBI that Go-Auto owed Gensol Rs. 21.25 Crore as interest, while also noting a net payable of Rs. 5.37 Crore from Gensol (on a consolidated basis) to Go-Auto [Para 56].

SEBI itself calculated that Gensol had transferred Rs. 775 Crore to Go-Auto, which is Rs. 207.27 Crore more than the Rs. 567.73 Crore cost of the 4,704 EVs delivered [Paras 54, 57].

This excess payment, coupled with Go-Auto still claiming receivables, strongly points towards the likelihood that the difference represents funds diverted through Go-Auto to other connected entities, as alleged by SEBI [Para 57]. The conflicting statements on dues could potentially be an attempt to muddy the waters regarding the actual financial flows.

The independence of Go-Auto's directors (Ajay and Mukesh Agarwal) from the Jaggi family and their potential awareness or involvement in the alleged scheme remain critical unanswered questions.

Tracing the Diverted Funds: Sample Loan Analysis

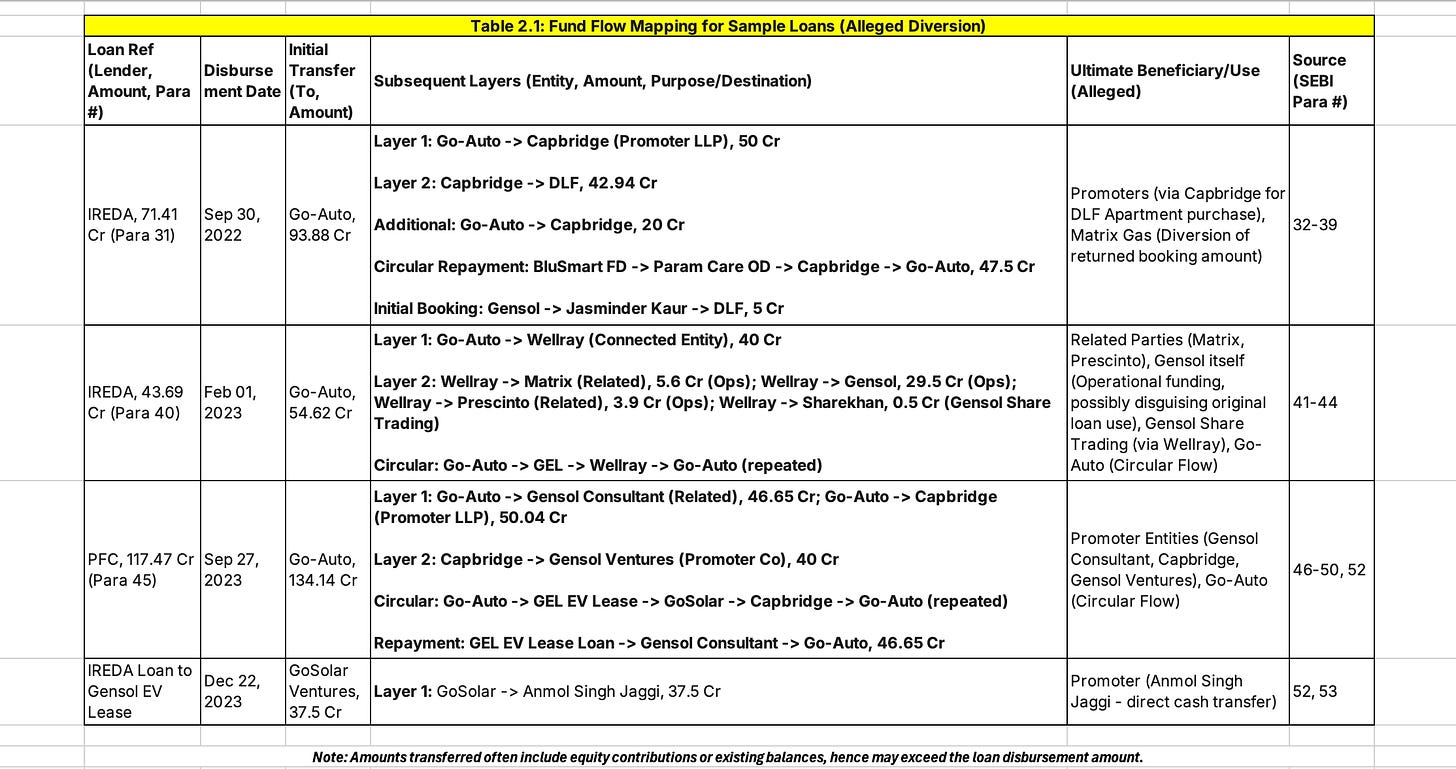

SEBI detailed the fund flows for three specific loans on a sample basis to illustrate the mechanism of alleged diversion and misutilization [Para 29].

1. Loan for Rs. 71.41 Crore from IREDA (Sanctioned FY 2022-23) [Paras 31-39]:

Disbursement: On September 30, 2022, Gensol received Rs. 71.39 Cr from IREDA into a designated Trust and Retention Account (TRA) with Axis Bank. Gensol added Rs. 26.06 Cr as promoter contribution, totaling Rs. 97.46 Cr [Para 32].

Transfer to Conduit: On October 3, 2022, Rs. 93.88 Cr was transferred from the TRA to Go-Auto's HDFC Bank account [Para 33].

Immediate Diversion: On the same day (Oct 3, 2022), Go-Auto transferred Rs. 50 Cr to Capbridge Ventures LLP (an entity where Anmol Singh Jaggi and Puneet Singh Jaggi are designated partners) [Paras 30, 33].

Personal Use (Real Estate): On October 6, 2022, Capbridge transferred Rs. 42.94 Cr to DLF Limited as partial payment for a luxury apartment in 'The Camellias', Gurgaon. This apartment was initially booked with a Rs. 5 Cr advance paid by Jasminder Kaur (promoters' mother) on September 29, 2022. SEBI traced this Rs. 5 Cr advance itself back to Gensol through layered transactions. The allotment was later transferred from Jasminder Kaur to Capbridge.

Further Diversion: When DLF returned the initial Rs. 5 Cr advance to Jasminder Kaur on November 21, 2022, these funds were not returned to Gensol but were instead transferred to another related party, Matrix Gas and Renewables Ltd. [Para 37].

Additional Funding & Circular Repayment: Capbridge received another Rs. 20 Cr from Go-Auto on December 31, 2022 (prima facie diverted from another IREDA loan) [Para 38]. On March 31, 2023, Capbridge repaid Rs. 47.50 Cr to Go-Auto. SEBI traced the source of this repayment to Param Care Pvt. Ltd. (a related party), which funded it via an overdraft facility from Bandhan Bank, secured against a Rs. 50 Cr Fixed Deposit subscribed by Blu-Smart Mobility Pvt. Ltd. (another related party) [Para 39]. This complex repayment structure, involving multiple related parties and potentially circular funding, requires further investigation.

2. Loan for Rs. 43.69 Crore from IREDA (Sanctioned FY 2022-23) [Paras 40-44]:

Disbursement: On February 1, 2023, Gensol received Rs. 43.68 Cr from IREDA into another Axis Bank TRA. Gensol added Rs. 13.13 Cr equity, totaling Rs. 56.82 Cr [Para 41].

Transfer to Conduit: On the same day (Feb 1, 2023), Rs. 54.62 Cr was transferred to Go-Auto's HDFC Bank account [Para 42].

Diversion to Connected Entity: On February 2, 2023, Go-Auto transferred Rs. 40 Cr to Wellray Solar Industries Private Limited (an entity connected to Gensol promoters, discussed later) [Para 42].

Further Dispersal: On the same day, Wellray made outward transfers totaling Rs. 39.50 Cr:

Rs. 5.60 Cr to Matrix Gas (related party) for operational expenses.

Rs. 29.50 Cr back to Gensol Engineering Limited for its operational expenses.

Rs. 3.90 Cr to Prescinto Technologies Pvt. Ltd. (related party) for its operational needs.

Rs. 50 Lakh to stockbroker Sharekhan Limited, subsequently used for trading in Gensol's own shares [Para 42].

Circular Flow: SEBI noted evidence of circular fund movement where Go-Auto transferred funds to Gensol, which transferred to Wellray, which then transferred back to Go-Auto. An amount of ≥ Rs. 8.5 Crore was circulated four times between November 28-29, 2023, using this route [Para 44].

3. Loan for Rs. 117.47 Crore from PFC (Sanctioned FY 2023-24) [Paras 45-53]:

Disbursement: On September 27, 2023, Gensol received Rs. 117.47 Cr from PFC into a designated ICICI Bank Construction Fund Account. Gensol added Rs. 29.37 Cr equity, totaling Rs. 146.84 Cr [Para 46].

Transfer to Conduit: On September 29, 2023, after an internal transfer, Rs. 134.14 Cr was transferred from Gensol to Go-Auto's ICICI Bank account [Para 47].

Immediate Diversion to Related Parties: Immediately upon receipt (Sep 29, 2023), Go-Auto transferred Rs. 96.69 Cr to two related entities:

Rs. 46.65 Cr to Gensol Consultant Pvt. Ltd.

Rs. 50.04 Cr to Capbridge Ventures LLP [Para 47].

Further Layering: On the same day, Capbridge transferred Rs. 40 Cr to Gensol Ventures Pvt. Ltd. (a promoter group entity) [Para 47]. SEBI observed that Rs. 96.69 Cr was prima facie diverted to promoter and promoter-linked entities, bypassing the stated EV purchase end-use [Para 48].

Circular Flows & Repayments:

SEBI identified another circular flow: Go-Auto -> Gensol EV Lease Pvt. Ltd. (subsidiary) -> GoSolar Ventures Pvt. Ltd. (related) -> Capbridge -> Go-Auto. An amount of Rs. 10 Crore was circulated four times on January 4, 2024 [Para 50].

Capbridge transferred an additional Rs. 10 Cr back to Go-Auto using funds received from Gensol EV Lease / Blu-Smart [Para 51].

Gensol Consultant transferred Rs. 46.65 Cr back to Go-Auto using funds received from Gensol EV Lease. Notably, Gensol EV Lease had received these funds from loans sanctioned to it by IREDA in FY 2024 [Para 52].

Direct Promoter Benefit: Analysis of the fund flow from Gensol EV Lease's IREDA loan (Rs. 171.30 Cr disbursed Dec 22, 2023) showed that after passing through GoSolar Ventures, Rs. 37.5 Crore was ultimately transferred directly to Anmol Singh Jaggi on December 27, 2023 [Paras 52, 53].

These detailed examples consistently demonstrate a pattern:

Loan funds designated for EV purchase were immediately moved to Go-Auto, which then acted as a hub to rapidly disperse large amounts through multiple layers involving various related parties (Capbridge, Wellray, Matrix, Gensol Consultant, Gensol Ventures, Param Care, BluSmart, Gensol EV Lease).

This complex layering appears intentionally designed to obscure the final destination and end-use of the funds, making it challenging for auditors and lenders to trace the money trail effectively. Simple diversion is easier to detect; using multiple entities and circular transactions creates a web that requires forensic accounting to unravel, thereby potentially delaying or preventing detection.

Crucially, the fund flows do not merely show transfers between related businesses; they reveal direct financial enrichment of the promoters and their family. The purchase of the DLF apartment via Capbridge [Paras 34-37] and the direct transfer of Rs. 37.5 Cr to Anmol Singh Jaggi from a subsidiary's loan [Para 53] are clear examples. This points to the alleged use of the listed company and its subsidiaries as a personal treasury for the promoters, aligning with SEBI's observation that the company was run like a "promoters' piggybank".[2]

Bank Due Diligence Lapses

The apparent ease and speed with which substantial funds were allegedly diverted raise serious questions about the effectiveness of due diligence and ongoing monitoring by the lending institutions (IREDA, PFC, and potentially others like Axis, HDFC, ICICI, Bandhan whose accounts were involved).

Standard banking due diligence for corporate loans involves verifying the borrower's financial health, assessing project viability, understanding the proposed use of funds, checking vendor credentials (especially for large procurement), and scrutinizing related party transactions.The ICSI Guidance Note on Diligence Reporting for Banks specifically emphasizes verifying that funds are used for the stated purpose and examining related party dealings. Vendor due diligence in India typically includes verifying legal status, financial stability, operational capability, and legal compliance.[17]

In Gensol's case, several potential lapses emerge:

Vendor Verification: While Go-Auto's website currently shows details, SBI noted a lack of information earlier [Para 5]. Regardless, did lenders adequately verify Go-Auto's capacity and legitimacy as a bulk EV supplier capable of handling transactions worth hundreds of crores? Was its role as merely a pass-through entity missed?

End-Use Monitoring: The immediate outflow of funds from designated TRAs and Construction Fund Accounts [Paras 32, 41, 46] to Go-Auto, followed by rapid transfers to unrelated parties or for personal use, suggests potential weaknesses in monitoring these supposedly ring-fenced accounts. Robust monitoring should involve verifying underlying invoices, matching fund releases to actual asset creation (e.g., EV delivery documents), and flagging suspicious large transfers to non-project entities.

Document Verification: While the forged Conduct Letters/NOCs were submitted to CRAs [Paras 17-19], it raises the question of whether similar misrepresentations were made directly to lenders, and if lenders had adequate processes to cross-verify such critical documents directly with the purported issuing institutions (IREDA/PFC in this case).

The scale of lending involved (nearly Rs. 1000 Cr in term loans from just IREDA/PFC) should typically warrant heightened scrutiny and rigorous monitoring. The apparent failure to detect or prevent such large-scale, immediate diversion suggests that monitoring mechanisms may have been superficial or that established procedures were not diligently followed.

This systematic analysis of the fund flows highlights the intricate methods allegedly employed to move money away from its designated purpose and towards promoter-linked entities and personal use. The role of Go-Auto as a facilitator and the potential inadequacy of lender oversight are critical elements in understanding how this alleged scheme operated.

The next edition will examine the broader patterns of fund movement involving Gensol and its connected entities, particularly Wellray Solar Industries Private Limited. It will explore how funds sourced from Gensol, including those potentially diverted from loans, were allegedly funneled through Wellray to benefit promoters personally, finance promoter investments in Gensol itself, and fund trading activities in Gensol's shares.

I hope this edition provided a good overview of fund misappropriation by Gensol Engineering and its promoters. Do drop in a comment with your thoughts!