#22 Gensol Engineering Limited: Genesis of the investigation: financial ascent and regulatory scrutiny. (Series Part I)

An Analysis of Corporate Governance Failures and Alleged Fund Diversion by Gensol Engineering, and its promoters Anmol Singh Jaggi and Puneet Singh Jaggi.

On 16-April 2025, SEBI published its interim order in the matter of Gensol Engineering, naming the company Gensol Engineering Limited, and its two promoters Anmol Singh Jaggi and Puneet Singh Jaggi.

The 29 page document read like a Matt Levine-Lawrence McDonald-Bethany McLean-Michael Lewis book. While there is so much to unpack, I couldn’t resist the temptation of writing about the fiasco. I have been fascinated by financial crime and history of the financial sector - be it Enron, Lehman Brothers, the 2008 Financial Crisis, the RJR Nabisco LBO fiasco, the Crypto bubble, or the FTX implosion.

I usually satiate my appetite with colourful commentary by the GOAT, Matt Levine, or books and articles from the Financial Times and Bloomberg. For Gensol Engineering, though, I thought I would attempt to write something myself.

I have divided the writeup into four segments:

Segment 1: Genesis of the Investigation: Financial Ascent and Regulatory Scrutiny

Segment 2: Anatomy of Alleged Fund Misappropriation: The EV Procurement Facade

Segment 3: Expanded Fund Trails, Related Party Transactions, and Governance Implications

All references to [para xyz] are made on the SEBI interim order, which can be accessed using this link: https://www.sebi.gov.in/enforcement/orders/apr-2025/interim-order-in-the-matter-of-gensol-engineering-limited_93458.html

Introduction

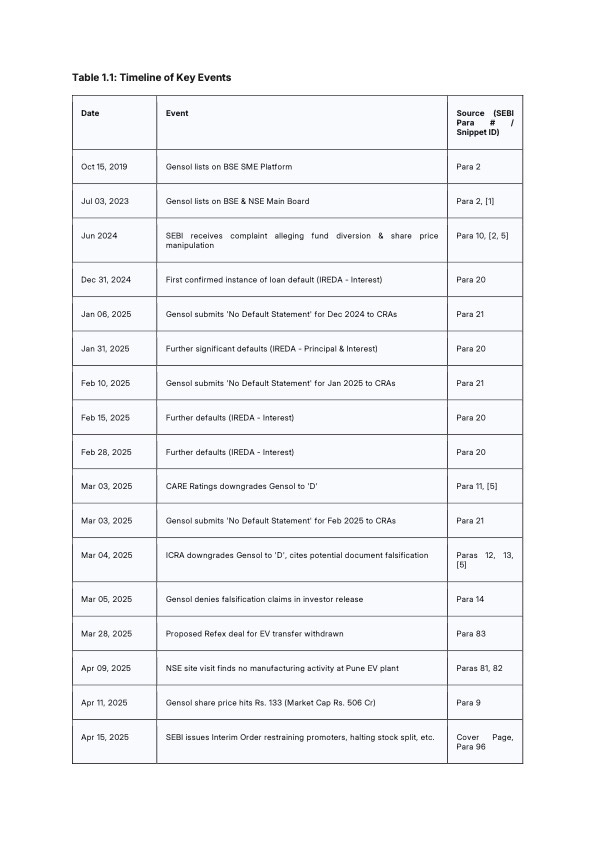

Gensol Engineering Limited (Gensol/GEL), a company engaged in solar consulting, Engineering, Procurement and Construction (EPC), and electric vehicle (EV) leasing [Para 1], presents a compelling case study in rapid corporate growth juxtaposed with subsequent allegations of severe corporate governance failures and financial irregularities. Initially listed on the BSE SME Platform in October 2019 and migrating to the main boards of BSE and NSE in July 2023 [Para 2], Gensol exhibited a remarkable expansion trajectory. However, this impressive growth narrative was abruptly challenged by credit rating downgrades, loan defaults, and ultimately, a comprehensive investigation by the Securities and Exchange Board of India (SEBI), initiated following a complaint in June 2024 alleging share price manipulation and fund diversion [Para 10]. This segment examines the background leading up to the SEBI investigation, detailing Gensol's financial performance, shareholding evolution, and the sequence of events that triggered regulatory scrutiny.

Overview

Gensol Engineering's journey involved diversification from solar services into the burgeoning EV sector, marked by exponential growth in sales, profits, and balance sheet size between FY 2017 and FY 2024 [Paras 1, 3, 4]. This financial ascent was mirrored by a significant expansion of its shareholder base and a dramatic, albeit volatile, increase in its share price post-listing [Paras 6, 9]. However, beneath this veneer of success, significant financial stress emerged, leading to defaults on loan obligations in late 2024 [Para 20]. This distress prompted sharp credit rating downgrades to 'D' (Default) by CARE and ICRA in March 2025, with ICRA explicitly citing concerns over falsified documents and corporate governance practices [Paras 11-13]. These events, coupled with a prior complaint to SEBI, culminated in an interim order highlighting alleged misrepresentations to Credit Rating Agencies (CRAs), failure to disclose defaults, and potential fraud [Paras 10, 17-19, 23, 87].

Executive Summary

Gensol Engineering showcased extraordinary growth post its 2019 listing, with sales multiplying nearly twenty-fold and profits surging significantly by FY 2024. Its balance sheet expanded dramatically, largely fueled by increased borrowings, reaching over Rs. 1,000 Crore by H1 FY2025. This growth attracted a vast number of public shareholders, exceeding 109,000 by March 2025, even as promoter holding diluted substantially. However, this apparent success story unraveled rapidly. Beginning in late 2024, the company defaulted on multiple loan payments to key lenders like IREDA and PFC. Despite these defaults, Gensol allegedly submitted 'No Default Statements' and forged 'Conduct Letters' and 'No Objection Certificates' to CRAs to maintain a façade of financial health. These actions, discovered following credit rating downgrades to 'D' in March 2025, triggered a SEBI investigation that unearthed prima facie evidence of fund diversion, fraudulent practices, and a severe breakdown in corporate governance, leading to significant regulatory intervention.

Analysis

Gensol's Business & Growth Trajectory

Gensol Engineering Limited, headquartered in Ahmedabad, operates primarily in solar consulting, EPC services, and the leasing of electric vehicles [Para 1]. Its initial public offering occurred on the BSE SME Platform on October 15, 2019, followed by a significant transition to the main boards of both BSE and NSE on July 3, 2023.

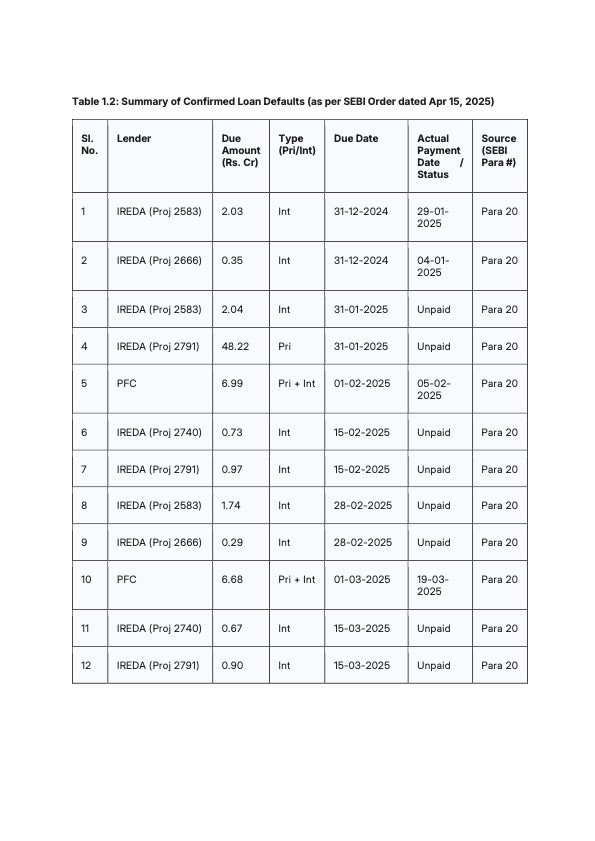

The company's financial performance, based on publicly available data, demonstrated exceptional growth in the years following its listing. On a standalone basis, sales surged from Rs. 61 Crore in FY 2017 to Rs. 1,152 Crore in FY 2024, with trailing 12-month data indicating a further rise to Rs. 1,297 Crore. Operating profit climbed from Rs. 2 Crore to Rs. 209 Crore, and net profit escalated from Rs. 2 Crore to Rs. 80 Crore over the same period [Para 3]. This operational expansion was mirrored in its balance sheet, which ballooned from Rs. 10 Crore in FY 2017 to Rs. 2,202 Crore in the first half of FY 2025. A key driver of this expansion was debt; borrowings increased from nil in FY 2017 to Rs. 1,045 Crore in H1 FY2025, having peaked at Rs. 1,260 Crore in FY 2024 [Para 4]. This rapid, debt-fueled growth, while impressive on the surface, laid the groundwork for the financial vulnerabilities that would later emerge.

Shareholding & Market Performance

The company's transition from the SME platform to the main board coincided with a massive increase in its shareholder base.

From just 155 shareholders in FY 2020, the number exploded to 109,872 by March 31, 2025 [Para 6]. During this period, the promoter shareholding saw a significant dilution, decreasing from 70.72% in FY 2020 to 35.125% by March 31, 2025. Consequently, public shareholders held nearly 65% of the company [Paras 6, 7].

This high public float, comprising largely retail investors, amplified the potential impact of any adverse findings regarding the company's governance and financial health.

The company's share price reflected its reported growth, reaching a high of Rs. 1,126 per share, translating to a market capitalization of approximately Rs. 4,300 Crore at its peak. However, the subsequent revelations and financial troubles led to a dramatic collapse. By April 11, 2025, the share price had plummeted to Rs. 133, reducing the market capitalization to just Rs. 506 Crore [Para 9]. This represented a destruction of over Rs. 3,800 crore in market value, underscoring the severe consequences of the unfolding crisis for investors. The stock experienced significant volatility, hitting lower circuits frequently in March and April 2025, and was placed under the Enhanced Surveillance Measure (ESM) framework by both BSE and NSE, signaling high perceived risk.

The Trigger: SEBI Complaint & Credit Downgrades

The catalyst for the formal SEBI examination was a complaint received in June 2024, alleging manipulation of Gensol's share price and diversion of funds. While SEBI began its examination, the situation escalated publicly in early March 2025.

On March 3, 2025, CARE Ratings downgraded Gensol's fund-based and non-fund based credit facilities to 'D' (Default) due to delays in servicing debt obligations.ICRA Limited followed suit on March 4, 2025, also assigning a 'D' rating.[5] ICRA's press release was particularly damaging, stating the downgrade followed feedback from lenders about ongoing debt servicing delays.

Crucially, ICRA added that Gensol's public disclosures and communications had highlighted "sizeable available liquidity," creating a stark contradiction with the reality of defaults. Furthermore, ICRA explicitly stated that "certain documents shared by GEL with ICRA, on its debt servicing track record, were apparently falsified, which raises concerns on its corporate governance practices, including its liquidity position". These downgrades and the specific allegation of document falsification served as major red flags, intensifying regulatory scrutiny.

Misrepresentation to CRAs & Lenders

In response to the CRAs' queries, triggered by news reports concerning a default by related party BluSmart Mobility Private Limited, Gensol initially maintained that it was regular in its debt servicing and unaffected by BluSmart's issues [Paras 15, 16].

When CRAs requested term loan statements, Gensol provided them for all lenders except IREDA and PFC. For these two critical lenders, Gensol submitted 'Conduct Letters' purportedly issued by IREDA and PFC, claiming regular debt servicing [Para 17]. CARE Ratings also reported that Gensol requested a withdrawal of its ratings, supported by No Objection Certificates (NOCs) allegedly from its lenders [Para 18].

However, upon verification by the CRAs, both IREDA and PFC categorically denied issuing any such Conduct Letters or NOCs [Para 19]. Images of these allegedly forged letters were included in the SEBI order [Para 19]. This attempt to mislead CRAs (and potentially other stakeholders) through forged documents represents a severe breach of trust and potentially fraudulent activity.

Furthermore, despite experiencing defaults starting from December 31, 2024, Gensol continued to submit 'No Default Statements' to CRAs for December 2024, January 2025, and February 2025 (submitted on January 6, February 10, and March 3, 2025, respectively). The February 2025 statement explicitly confirmed "no over dues or default on payment of interest/ instalment obligations on loans from banks/ financial institutions" [Para 21]. This directly contradicted the reality of its financial situation as confirmed by lenders.

Failure in Disclosure

SEBI regulations mandate specific disclosures for listed entities. As per the SEBI Master Circular dated November 11, 2024 (Para 4.1, Section V-B), listed entities must disclose any loan default (including revolving facilities) from banks/financial institutions that continues beyond 30 days, promptly and no later than 24 hours from the 30th day of default [Para 22].

SEBI's investigation, based on information from IREDA and PFC, confirmed multiple instances of default by Gensol starting December 31, 2024 [Para 20]. Several of these defaults, including unpaid principal and interest amounts due on January 31, February 15, and February 28, 2025, clearly continued beyond the 30-day threshold by February 28 and March 31, 2025 [Paras 20, 23]. Gensol failed to make the required disclosures to the stock exchanges regarding these defaults, constituting a violation of LODR regulations [Para 23].

Timeline of Key Events:

Summary of loan defaults:

The sequence of events, from rapid growth fueled by debt to confirmed defaults concealed by alleged forgery and non-disclosure, paints a picture of a company under severe stress, resorting to potentially illicit means to maintain appearances. This set the stage for SEBI's deeper investigation into the end-use of borrowed funds.

In the next edition, we will explore the core allegations leveled by SEBI concerning the misappropriation and diversion of funds by Gensol Engineering and its promoters, Anmol Singh Jaggi and Puneet Singh Jaggi. The focus is primarily on substantial term loans obtained from the Indian Renewable Energy Development Agency Ltd. (IREDA) and Power Finance Corporation (PFC), ostensibly for the procurement of a large fleet of Electric Vehicles (EVs).

I hope this edition provided a good overview of regulatory scrunity of Gensol Engineering, and its promoters. Do drop in a comment with your thoughts!