#12 Amazon and Google's War on Retail Advertising

Analysing advertising revenue growth for Amazon and Google in the retail space and recent developments as highlighted in the Q2 Earnings Reports of both companies.

The final weeks of July 2021 saw some very interesting developments happening across the world in the field of technology, business, and startups. This edition of the newsletter highlights some of those developments that caught my attention, specific to retail advertising, Amazon, and Google.

Amazon Ad-Revenues

Amazon’s advertising revenues grew 87% since the last year, based on the Q2 earnings report.

With its current revenue run rate, it is poised to be a USD 32 Billion dollar business, which is more than the combined annual advertising revenues of Twitter, Snapchat, Roku, and Pinterest.

Also mentioned in the Q2 earnings report was this segment on Amazon’s advertising offerings:

Amazon Advertising launched over 40 new features and self-service capabilities, making it easier for sellers, companies, and authors to grow their businesses by helping customers discover their brands and products. Recent launches include regional sponsored product campaign creation tools; access to educational, technical, and marketing resources via the Partner Network; and a simplified creative asset management solution.

Also from Amazon - Advertising Based Streaming Service

IMDb TV will be the first advertising-based streaming service to secure a major studio network window, which traditionally goes to broadcast or cable networks.

Prime Video and IMDb TV announced an exclusive, multi-year licensing deal with Universal Filmed Entertainment Group (UFEG). Beginning in 2022, Prime Video will be an exclusive subscription video partner for UFEG’s slate of live-action films in the U.S., bringing films such as Jurassic World: Dominion, The 355, and Ambulance to Prime Video soon after theatrical release.

This will be an interesting space to watch out, with its competitors deploying their own initiatives towards ensuring profitability - Hotstar (international expansion) and Netflix (Netflix Games).

Google’s Hidden Weapon for Retail - Google Shopping

Google’s Q2 earnings report was impressive, and some of the numbers being absolute bonkers, especially considering the ensuing pandemic situation.

Google’s parent company flexed its digital dominance, reporting its highest quarter ever for sales and profit behind a gusher of online advertising from businesses vying for customers across reopened economies. The robust results showcased how Google has emerged stronger from a Covid-19 pandemic that accelerated e-commerce purchases, online food orders and streaming video consumption.

The burst in digital activity led companies to pour marketing dollars into ads across Google Search, Maps and YouTube, underscoring the pre-eminence of its products.

Alphabet Inc. reported second-quarter revenue of $61.88 billion, an increase of 62% from a year earlier, when its unassailable ad business tumbled as the coronavirus crippled the economy. Profit more than doubled to $18.53 billion, with per-share earnings surpassing analysts’ expectations.

62% growth is an absolutely bonkers number for a company the size of Google, but it is, at least at first glance, tempered by the fact that Google was hit pretty hard by COVID’s impact on categories like Travel. It’s better to look at two-year growth rates. Even then, Google revenues are up 55%, which is absolutely bonkers! That’s the highest two-year growth rate in nine years, which is when mobile advertising really started to take hold.

Google has a lot going in its favour: first, there are the same factors that are affecting everyone in digital, including the secular shift to digital advertising and the pull-forward of COVID. Google, though, has two additional factors moving in its favour, for which Google itself deserves credit. One is Youtube’s brand advertising, which CFO Ruth Porat reported: “YouTube advertising revenues of $7.0 billion, were up 84%, driven by brand, followed by direct response.”

The first one goes back to last April and Google’s revamping of Google Shopping to make listings free. This strategy performed exceptionally well, as increasing the supply of shopping listings improves the overall product, increasing usage, which increases the value of promoted listings that are shown to the user first.

Chief Business Officer Philipp Schindler noted that “retail was, again, by far, the largest contributor to the year-on-year growth of our Ads business.”

Google’s Q2 Earnings Report Transcript:

Moving onto Retail, where momentum remains strong. We’re continuing to build an open ecosystem that benefits both users and merchants. Last year we removed financial barriers with free product listings and zero commission fees.

This year we’re removing integration barriers. With Shopify, WooCommerce, GoDaddy and Square, merchants can now onboard and show their products across Google for free.

And our Shopping Graph is using AI to connect these products to the people who want them, with over 24 billion listings from millions of merchants across the web.

Let’s talk omnichannel. Last quarter I said it was here to stay – and it is. Retailers continue to build their digital presence to drive both online and offline sales – and we’re helping them do it.

Take Bed Bath & Beyond who quickly pivoted to curbside pickup, pick-up-in-store, and same-day delivery when people were stuck at home. They’ve continued these offerings across Google with impressive success.

Omni and digital shoppers now make up 50% of customers, and in Q1, a third of total digital sales were fulfilled by stores. Plus they’ve tapped YouTube to build awareness for their new customer-inspired Owned-brands. We’ll continue to invest in new ways to help retailers through what is likely to be a long and uncertain recovery around the world.

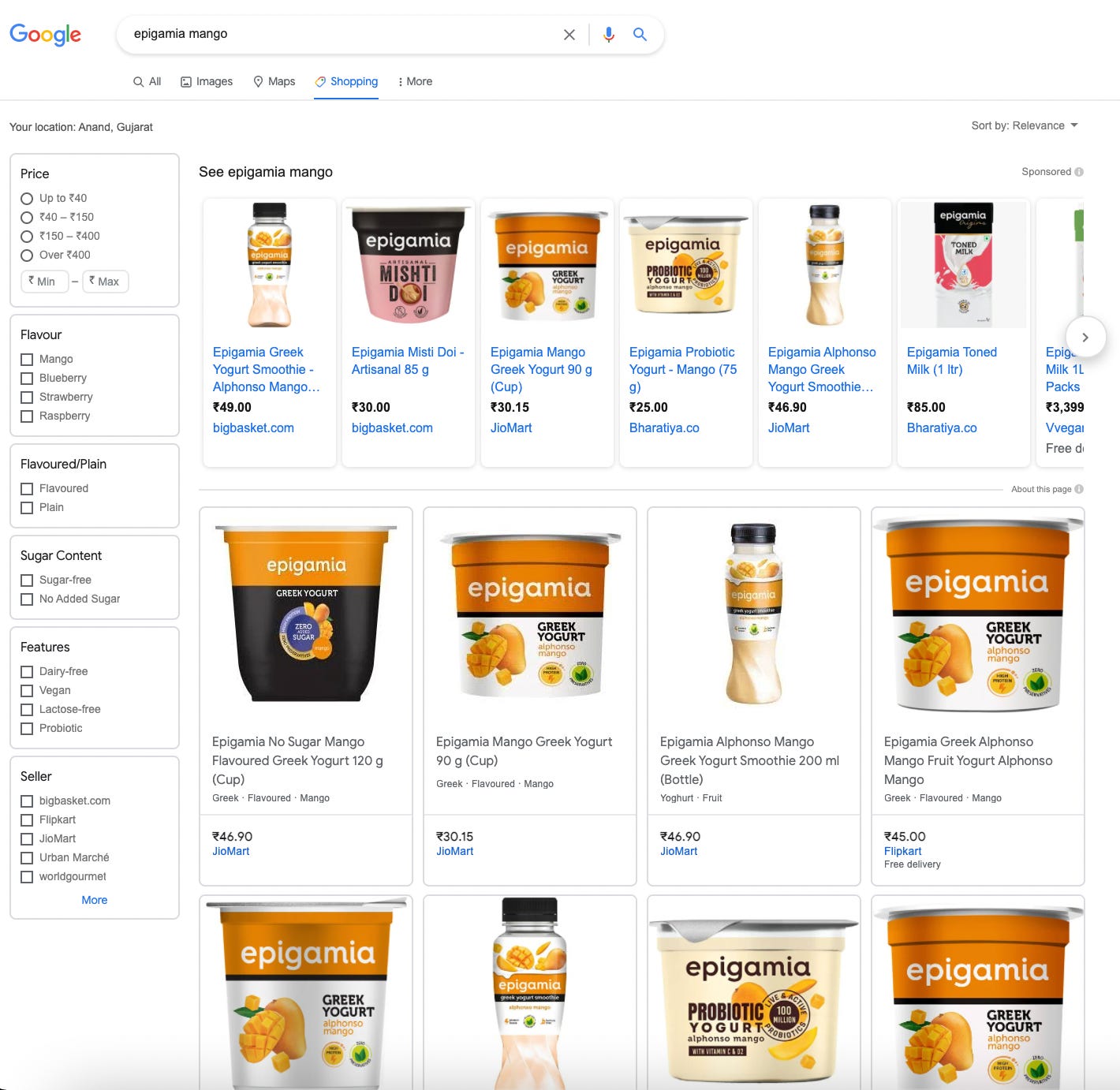

I do not know many people who use Google Shopping in India, but it has always been an integral part of my work in analysing pricing points for various items in retail. With the recent foray into Omni-channel sales, this website becomes even more important. You do find some interesting results through Google Shopping, which is increasingly becoming relevant in the India advert market, right alongside Amazon’s advert offerings.

Case in point, both of the search parameters in the following images show their own D2C channel, instead shows aggregators and other eCommerce platforms. However, direct Google listings do connect to the stores. This seems to be a mismatch from a business standpoint.

Way Forward

It will be interesting to see how Amazon and Google play out in their efforts to capture the advertising market for retail in India in the months to come. With Omni-channel sales strategy dominating the ecosystem, and the increase in D2C brands, it will be interesting to see how this space unfolds. The Anti-Amazon alliance might just get a boost from Reliance Jio and its efforts towards investments in Jio Mart and its bet on the hyperlocalisation of retail across India.

Bonus: Rethinking Business Travel - A Fresh Perspective

A recent edition of the Dealbook newsletter by the NYTimes written by Kevin Delaney i explores a fresh perspective to business travel in the post-pandemic world. Mr Delaney is the co-founder and editor in chief of Charter, a media and services company focused on transforming workplaces.

It references multiple perspectives providing a balanced view of how business travel is essential to form relationships that are just not possible via the teleconferencing mediums (like Zoom or Webex), and how do we take a holistic approach towards evaluating the cost-benefits while deciding travel policies.

I link this to an old The Knowledge Podcast featuring the famous marketer Rory Sutherland.

I think an example I always give of that, I think there need to more, is the

example of video conferencing, which I think should’ve been adopted much

more. Bear in mind, I aim to be really clear here, I don’t think I would ever

have been able to predict this in advance. I think this is a post-rationalizing,

and it may even be wrong. It’s a theory of mine that part of what went wrong

with video conferencing was it was sold as the poor man’s alternative to air

travel, not the rich man’s phone call. Video conferencing was like owning a

pager in about 1989. It was what your company gave you when they didn’t

trust you with a mobile phone. A video conference was what your company

allowed you to do when they didn’t allow you to board a flight to Frankfurt.Now, if you’d made video conferencing the way that chief executives made

phone calls, I think you could’ve sold it much, much more. You could’ve made

it something aspirational rather than a poor sap’s substitute for something

better. It should’ve been the rich man’s British Telecom, not the poor man’s

British Airways.A fairly large part of air travel may be driven by costly signaling. Possibly, if you’d made video conferencing cost 4,000 pounds an hour, possibly you would’ve replaced air travel more effectively. A large part of the reason for air travel is not that you couldn’t do what you do on a phone call. It signals through both the cost of the tickets and the effort required to make the journey the importance of a client’s business.