#10 Semi Final Word - The Zomato IPO

Explores advert-to-transaction throughputs, Hyperpure as path to profitability, vortex of delivery costs, controversial Zomato Pro, average order value and gourmet segment, and the milestone of an IPO

In the past week alone, I went through the Red Herring Prospectus of Zomato, along with 5 other independent reports from various entities including Motilal Oswal, HDFC, and Axis. As I write this on 13th July a day before the IPO subscription begins, I realise how far our Indian startup ecosystem has come, and how much of our world has changed due to organisations like Zomato.

However, the focus of this writeup is to sneak in some non-financial yet crucial strategic components of Zomato IPO that I believe may have some impact on the decision of retail investors (at least) whether or not they take a plunge and subscribe to the IPO. This post will also be quite short, as I do not have much to say. But I wanted to connect the dots and make sense for myself. I will try and uncover more of the interesting and latent variables that I believe might be important to consider, and probably does drive value for Zomato’s business at large.

Disclaimer: I am not a financial person. However, I have spent a long time trying to understand the concept of “value”, and how do we recognise the business value and long-term strategic competitive advantage (for the Buffet enthu cutlets, this is management science equivalent of ‘moat’).

Advertisement to Transaction Throughput

It was interesting to see a decreasing advertisement and sales promotion expenses YoY trend, with the sharpest drop from INR 1338 Cr to INR 527 Cr from 2020 to 2021. Although the revenue saw a 24% due to the pandemic, the sales and advertisement costs fell over 150%. This indicates Zomato took a considerable effort in streamlining in reacting to the lockdown and controlling these costs, riding on the wave of people staying at home and massive availability bias.

What I tried to calculate is the relationship between the adverts and customer engagement, followed by customer transactions. Some of the numbers are as follows:

To achieve a MAU (Monthly Active Users - which means users that have visited the platform atleast once a month) of 32.1 million, they spent INR 13.75 per averaged monthly customer engagement.

The conversion rate of MAU to MTU (Monthly Transacting Users - users that transact atleast once on the platform per month) is about 21% - which results in 6.8 Million MTU. This conversion is a key performance metric to be tracked, and this has steadily increased over the years.

Advert to MTU will bring about a value of INR 64 per successful monthly transaction. Considering the average order value of FY21 as INR 393, this is a respectable acquisition to transaction value ratio.

Arguments of Deep Discounts

Deep discounts and Price Parity Agreements were a major focus of the Competition Commission of India grievance filed by the National Restaurant Association of India (NRAI). The RHP however shows a very different picture.

Costs of Discounts: Discounts are a cost to Zomato, and not the restaurant, as Zomato takes the net commission minus the discounts.

Over the period of FY20 to FY21, Zomato not only significantly increased the commission base (about 40%), but also managed to reduce their dependency on discounts (down by at least 50%).

Path to Profitability - Hyperpure

I believe one of the key value drivers for Zomato on its path to profitability is the business vertical of Hyperpure. Hyperpure is Zomato’s farm-to-fork supplies offering for restaurants in India. They source fresh, hygienic, quality ingredients and supplies directly from farmers, mills, producers and processors to supply to our restaurant partners, helping them make their supply chains more effective and predictable, while improving the overall quality of the food being served.

Through the Hyperpure offering, they supply ingredients spanning fruits and vegetables, groceries, dairy, poultry, meats and seafood, bakery items, gourmet and packaged foods, beverages and packaging to our restaurant partners which supply high-quality ingredients to restaurant partners.

I see the following strategic advantages with Hyperpure:

Restaurants are one of the largest consumers of ingredients and food produce.

The orders placed in bulk, with a significant ticket size (in terms of value), and less sensitive to fluctuations.

Higher customer lifetime values in the case of restaurants being primary clients for Hyperpure.

Significant margins for offbeat fresh ingredients with higher inventory turnarounds- olives, jalapenos, paprika, mushrooms, meat and fish, etc.

Consistent margins, with a potentially higher market share avenue in the case of normal and offbeat ingredients like masalas and chutneys and cooking essentials. Also with consistent inventory turnaround times.

Although they compete with the likes of Flipkart, Tata Consumer Products, etc their strategic competitive advantage lies in the higher lifetime value of customers who already are their customers (reduced customer acquisition costs), and as well as controlled costs of handling and inventory turnarounds.

Hyperpure’s growth has been phenomenal. The revenue from the sale of traded goods, which includes the revenue from the Hyperpure operations, was INR 200 Crores, a sharp increase from 14 Crores when it began in 2019.

I believe the gross margins here can be anywhere in the range of 3% to 20%, with very few costs on the sales and marketing side of the business. This makes it a highly lucrative business, especially with the recent acquisition of Grofers.

The last-mile delivery through their delivery executives also is synergetic to their existing business value proposition, which makes the whole thing even more exciting.

The Vortex of Delivery Costs

I have observed a consistent trend in most of the hyperlocal delivery startups - the high costs of transportation. Be it grocery deliveries, or Amazon, or the emerging D2C space, I find a significant chunk of the unit economics on the cost side, about 40% or so. In the case of Zomato, it currently lies at 50.8% of the unit costs.

With rising fuel costs, this is far from seeing any reduction whatsoever in the months and years to come. The two offsets to these costs can be summarised in the following:

Vertical integration to Hyperpure has great synergies in lowering the costs of transportation overall.

Emergence of Ather and other electric vehicle scooters in India might reduce the burden of transportation costs in another two years or so.

No wonder Amazon’s success has a significant focus on lowering the cost structure to offset the delivery costs, as this is one segment most hyperlocal delivery businesses struggle with since the advent of eCommerce.

The Controversial Prince - Zomato Pro

Zomato has an exclusive paid membership program, Zomato Pro, which unlocks flat percentage discounts for their customers at select restaurant partners across both food delivery and dining-out offerings. These discounts are available to their customers on all days of a year (except during a few pre-determined festive days) and the Pro Restaurant Partners choose and fund the percentage discount available to Pro Members at their restaurants. The customers become Pro Members by paying a membership fee. The program allows Pro Restaurant Partners to market themselves to a select audience.

All said and done, I believe Zomato found an exceptional way to monetising the restaurant dining component of the food-access-delivery value chain of their business. It provides signalling of exclusivity, enables a more targeted marketing material for restaurants, and serves well for the price-sensitive customers with disposable income. The most misjudged element of Zomato Pro has been the adverse effects on the restauranteurs.

An effect opposite of this has been observed. What Zomato Pro provides is a steady pipeline of customers, with a locked-in, assured minimum cash flow per customer for a restaurant, which in turn increases the overall customer lifetime value of the restaurant business in the long run.

Average Order Value - The Gourmet Segment

One of the most interesting changes I observed in the food delivery business after the pandemic hit in March 2021 was the new segment of gourmet food being delivered online. Having stayed in Bombay, I saw some pricey names on the list of restaurants, that includes names like ITC, JW Marriot, Starbucks, and other 3 star or higher restaurants.

This caters to a segment of customers very different from the traditional target segment. The onset of the listings of gourmet food joints is a strategic move on the part of delivery business to drum up higher “Average Order Values” (AOV). With mobility restricted, a lot of customers were delighted to see some of these listings.

With declining customers, these pricey dine-ins saw a great value add to avail a steady stream of customers, however few in number, but a greater availability. Any margin charged on a higher AOV contributes to positive cash flows and business growth.

This listing also creates long-term partnerships for gourmet ingredients being sold to these pricey restaurants through Hyperpure, something that Swiggy and the other players are unable to do at the moment.

By assuring best quality farm-to-fork solution, this segment is bound to increase in the B2B segment, which might also see an offset into D2C segments through with these pricey restaurants being an excellent sales channel.

The Conundrum of Marketing Restaurants

Unlike marketing in the retail segment, marketing for restaurants has been a challenge since ages, especially with the rise of the consumer internet space.

The reduction of information asymmetry in the restaurants segment and space has always been my favourite part of Zomato, since its inception.

I used to know the ins and outs of the entire Zomato listings of every city I have lived in since 2013. Zomato monetised this through their advert revenue, which earlier was the only revenue stream before the food delivery business. However, we must not underestimate the intrinsic value that this marketing channel provides us with - to both restaurants and consumers. I believe restaurants have an improved ratio of “marketing costs to transaction revenue” on Zomato than any other platform, including the likes of Linkedin, Facebook, Twitter, Pinterest, TikTok, and direct marketing through Whatsapp.

What has been missing (or seems to be) is a sophisticated bidding based marketing revenue stream, with some focus on the user-generated content as well other allied avenues such as recipes, cooking shows, etc. I believe this is another very strong revenue stream and organic customer acquisition channel for Zomato.

The Semi-Final Word

It is safe to say Zomato has fundamentally changed the landscape of restaurants and food delivery in India in the last decade, and ushered a new era of hyperlocal food delivery and enhanced dine-in experience for millions of customers throughout the years. The staff at Inc42 did an extensive profile on Zomato back in 2019 when the company had expanded to international markets, a brilliant strategic move by the leadership. A brilliant summary of its history can be found in an excerpt taken from the inc42 profile:

FoodieBay.com Makes Way For Zomato

Zomato kicked off essentially as a rebranded version of the food directory services Foodiebay. Goyal and Chaddah, both IIT graduates and both working as analysts at Bain and Company back then, had started Foodiebay in 2008.In a matter of just nine months, FoodieBay became the largest restaurant directory in Delhi NCR. After two successful years, the company was rebranded Zomato and since then there was no looking back.

With support from its investors and multiple rounds of consecutive funding, Zomato built not only its valuation but also an interesting portfolio of investors which includes Info Edge India, Sequoia, Vy Capital, Singapore-based investment firm Temasek, and Alibaba’s Ant Financial. Ant Financial’s $200 Mn investment earlier this year led Zomato to cross the $1 Bn valuation.

This brief history lesson is important for us to anchor the milestone Zomato achieves through its IPO listing in the days to come. I understand the losses that the company has made, and its struggles with some of the ESG parameters as well as some high profile acquisitions. However, my innate belief is that the core drivers of the value proposition of this company are built on sound fundamentals. The leadership team has evolved the company into an exceptional powerhouse of innovation, marketing, and resolute business. In a way, they have fundamentally defined what it means to be a gig-economy business in India.

With Hyperpure in place, they are moving towards mobilising procurements that will not only create jobs and support agri-business, but also drive economic consumption and inject capital into the economy, with a great potential for enterprise creation in the coming years.

I have nothing but high hopes and best wishes to Zomato’s entire team for a successful listing, and continued growth and prosperity.

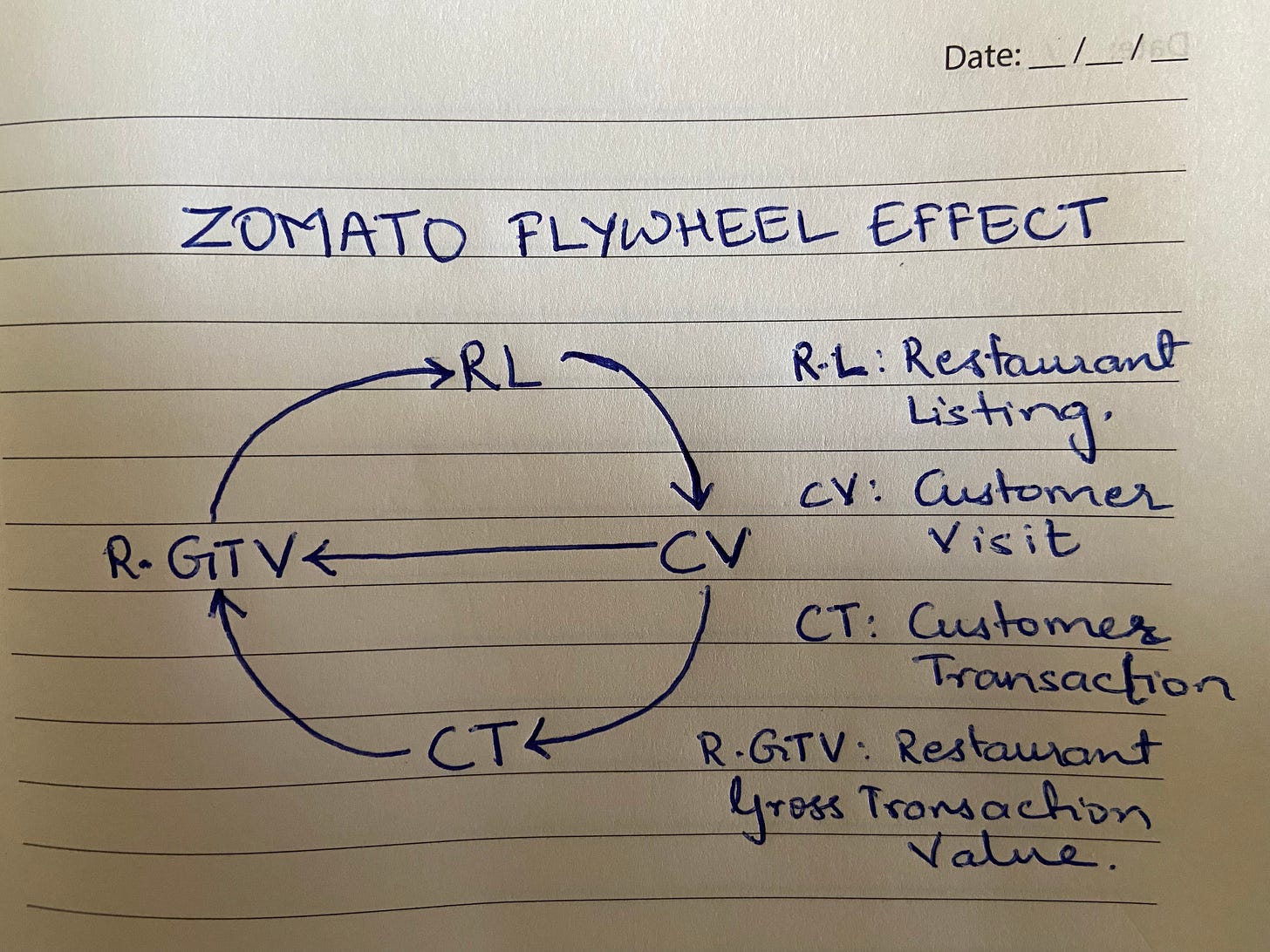

Annex: The Zomato Flywheel

I had referenced a flywheel diagram when I first wrote about the ESG performance of Zomato’s IPO filings, which I mention here:

Side Note Reference: I will reference what I believe to be a decent representation of the Zomato flywheel throughout the writeup, illustrated in the hand-drawn diagram below. Popularised by Jim Collins, the Flywheel Effect is a representation of a systemic view of the various drivers to the momentum inducing company growth and long-term value.

The flywheel shows the momentum created by the restaurant listings leading to high customer visits, which then increases the propensity of customer transactions, thereby increasing the restaurant GTV (gross transaction value). The increase in restaurant GTV prompts more restaurant listings and thereby adding to the momentum of customer visits leading to customer transactions. The original restaurant listing business also bridged the information asymmetry gap in the open markets, leading more customer visits from the platform into offline visits to the restaurants, thereby increasing the restaurant GTV. This found a space for restaurants listing advertisements on the Zomato platform in its earlier days. With the expansion of the basket of services that now includes food delivery, Zomato Gold, and HyperPure (Best-quality ingredients and kitchen products, delivered hassle-free to restaurant partners and consumers), they contribute to the flywheel illustrated in the diagram above.

Excellent read. Good job. OP.

Excellent read. Good job. OP.