#1 Zomato Limited IPO - An ESG Analysis

Analysing Zomato Limited's IPO filing from the lens of ESG performance to understand the company's efforts in mitigating investment risks and ensuring long-term sustainable financial returns.

TL;DR This edition of the newsletter covers the analysis of the ESG performance of Zomato Limited’s IPO filings. It covers some parameters on Environment, Social, and Governance aspects by Zomato, and recommendations for the same.

A lot has been written and analysed regarding the IPO filings of Zomato Limited (thereby called “Zomato”) with the Securities and Exchange Board of India, first published on 28-April, 2021. Zomato is one of the most popular startups in India, that rode the way of the first tech-startup boom of the late 2000s. It is safe to say Zomato has fundamentally changed the landscape of restaurants and food delivery in India in the last decade, and ushered a new era of hyperlocal food delivery and enhanced dine-in experience for millions of customers throughout the years. The staff at Inc42 did an extensive profile on Zomato back in 2019 when the company had expanded to international markets, a brilliant strategic move by the leadership. A brilliant summary of its history can be found in an excerpt taken from the inc42 profile:

FoodieBay.com Makes Way For Zomato

Zomato kicked off essentially as a rebranded version of the food directory services Foodiebay. Goyal and Chaddah, both IIT graduates and both working as analysts at Bain and Company back then, had started Foodiebay in 2008.In a matter of just nine months, FoodieBay became the largest restaurant directory in Delhi NCR. After two successful years, the company was rebranded Zomato and since then there was no looking back.

With support from its investors and multiple rounds of consecutive funding, Zomato built not only its valuation but also an interesting portfolio of investors which includes Info Edge India, Sequoia, Vy Capital, Singapore-based investment firm Temasek, and Alibaba’s Ant Financial. Ant Financial’s $200 Mn investment earlier this year led Zomato to cross the $1 Bn valuation.

Though a lot has been written and discussed on the company’s business model, financiers, financial health, operational capacity, unit economics, and strategic outlook, a key link that was missing from the investor analysis discourse was the ESG performance of the company.

Rationale

ESG performance has been a hotbed of innovation, company disclosures, and alternative financing from an investor perspective, emerging well into the limelight in the last two years. Beginning 2019, there was a sharp increase in ESG performance-related disclosures in the global markets as well as in Indian markets.

According to the “Reporting Matters” study of World Business Council for Sustainable Development (WBCSD), of the 158 sustainability reports published by Indian and global companies, 84% of the companies declared their ESG performance through sustainability reports using the GRI (Global Reporting Initiative) standards in 2020, moving from a meagre 13% in 2017.

Furthermore, the top 1000 companies in India voluntarily disclose their ESG performance through the Business Responsible Report (BRR), mandated by SEBI in their public disclosures to the investors. A recent circular by SEBI on 10th May, 2021 introduces a new format of the Business Responsibility and Sustainability Report(“BRSR”).

The BRSR is a notable departure from the existing Business Responsibility Report(“BRR”) and a significant step towards bringing sustainability reporting at par with financial reporting. The reporting requirements were finalized based on feedback received from public consultation and extensive deliberations with stakeholders including corporates, institutional investors. Further, a benchmarking exercise with internationally accepted disclosure frameworks was also undertaken.

The Carbon Disclosure Project (CDP) has Full Greenhouse Gas (GHG) Emissions Dataset. It's one of the most popular features of its investor membership package as it includes both self-reported and estimated Scope 1, 2 and 3 emissions data for over 5,000 companies. This is an essential tool for carbon footprint analysis and includes details of data quality and source information.

Need for ESG Disclosures by companies for Investors

In principle, all investors face similar challenges and consider similar issues, such as analyses of risk, including country, industry and policy risk, together with the assessment of competitive position, management quality, cash flow, financial returns and balance sheet strength. Most responsible investors use some form of screening/ filter/weighting/tilting strategy to avoid or mitigate specific ESG risks, such as reputational damage. However, some are now integrating ESG into their analyses, in order to identify positive impacts from contributions to the SDGs and to understand the effect a company has on the environment, communities, development, etc.

This provides a sense of the long-term strategic competitive advantage for a company, as it clearly outlines the risks towards the environment, its own internal and external stakeholders, as well as reputational risks based on governance. Companies that disclose ESG risks and performance metrics ensure that the top management is aware of investing company resources in mitigating these risks, which enable long-term business value for the company. This helps them in acquiring better terms with their suppliers, higher customer and employee retention, better engagement with the external board, and a strong base of investors who remain with the company ensuring its success in the long term. Each of these aforementioned factors helps optimise cost and increase revenue drivers for the company in the long term.

Companies looking to access capital via IPOs need to be particularly sensitive to the fact that environmental, social and governance (ESG) matters have become an integral part of every company’s equity story. They will increasingly be expected to provide information about the role ESG plays in their strategy, with a focus on the material value drivers and risks that can impact their financial position and performance. And with the momentum around establishing global standards on non-financial reporting, the focus on companies providing ESG information is gathering pace. Transparency about the company’s material ESG issues, such as its efforts to decarbonise its operations and supply chain, backed by reliable data, is therefore becoming more and more necessary for making that critical first impression.

Framework for ESG Performance Analysis

I was able to blend a couple of major national and international standards of sustainability reporting and ESG standards adopted by the top companies across the world. This includes the GRI reporting standards (I helped write one of the sustainability reports for a top telecom company in India using the GRI reporting standards, 2018-19), MSCI ESG Metrics, and the SEBI BRR. It also included the recently introduced voluntary disclosures framework and format by SEBI for its Business Responsibility and Sustainability Reporting disclosure.

Some of the key focus areas are enumerated below:

Performance on Environment parameters included those like

Materials

Water

Waste and Effluents (Solid Waste plus Effluent Waste)

Energy

Emissions

Supplier Environment Assessment

Performance on Social parameters included those like

Employees and Workers

Diversity and Inclusion

Occupational Health and Safety

Employee Training

Communities - including investments in corporate social responsibility and responsible social projects

Consumers protection

Customer data integrity, security, and privacy

Performance on Governance parameters included those like

Investor disclosures

Pending litigation

Anti-trust and Anti-Competitive Behaviour

Bribery and Corruption Controversies

Business Ethics Controversies

Taxes and Subsidies Controversies

Foreign Market Revenue Greater Than 20%

Deep Dive into the Zomato IPO filings and ESG Performance

I analysed the draft red herrings prospectus (DRHP) of Zomato dated 27 April 2021, the key document submitted to SEBI as the first step towards the company’s IPO. Over 400 pages long, this document gives an overview of the risk factors, the company information and overview, financial, legal, and other offer-related information. The way I have structured this writeup is to cover a majority of the topics under environment, social, and governance-related parameters specified in the section above separately, but bundled together on the major sub-headings of ESG. I will also delve into some of the recommendations that the company can invest in to enhance its ESG performance over the next couple of years, which will contribute substantially to the company’s long-term value contribution and its strategic competitive advantage.

Warning: This is neither an exhaustive list of all the parameters nor is it an indicator of investment advice. Please invest responsibly, and read the offer documents (DRHP) carefully before investing.

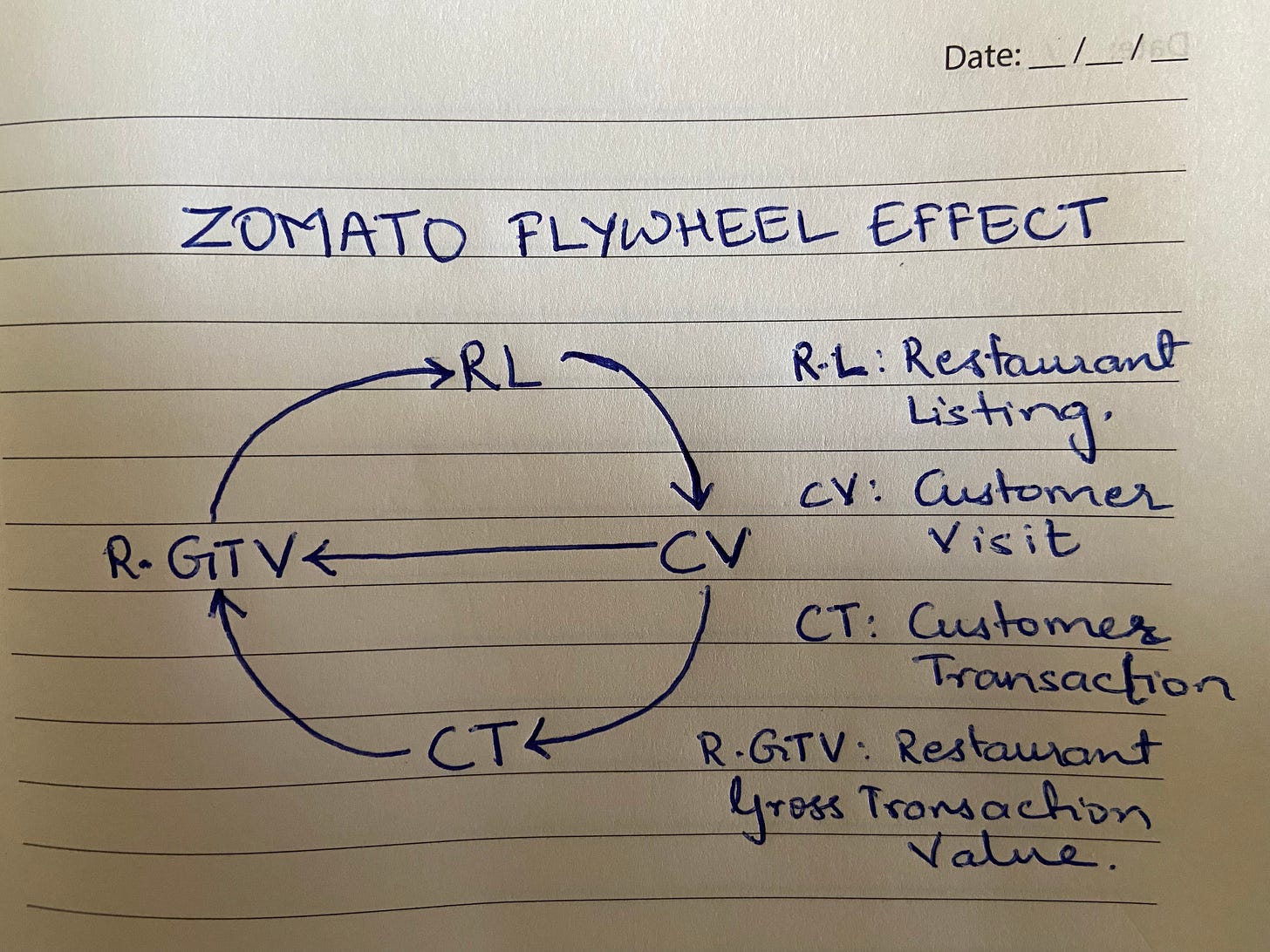

Side Note Reference: I will reference what I believe to be a decent representation of the Zomato flywheel throughout the writeup, illustrated in the hand-drawn diagram below. Popularised by Jim Collins, the Flywheel Effect is a representation of a systemic view of the various drivers to the momentum inducing company growth and long-term value.

The flywheel shows the momentum created by the restaurant listings leading to high customer visits, which then increases the propensity of customer transactions, thereby increasing the restaurant GTV (gross transaction value). The increase in restaurant GTV prompts more restaurant listings and thereby adding to the momentum of customer visits leading to customer transactions. The original restaurant listing business also bridged the information asymmetry gap in the open markets, leading more customer visits from the platform into offline visits to the restaurants, thereby increasing the restaurant GTV. This found a space for restaurants listing advertisements on the Zomato platform in its earlier days. With the expansion of the basket of services that now includes food delivery, Zomato Gold, and HyperPure (Best-quality ingredients and kitchen products, delivered hassle-free to restaurant partners and consumers), they contribute to the flywheel illustrated in the diagram above.

Environment Performance

One of the most glaring observations from the DRHP of Zomato is the complete absence of any concrete disclosure, acknowledgement of risk, analysis, intervention, action, or engagement on any of the critical environmental parameters mentioned in the aforementioned framework. Some of the key environmental risks I envision for the company moving forward are as follows:

Materials:

Of the major materials based environmental risks caused by Zomato, none is greater than the increased use of plastics and foil-based packaging materials by the restaurant partners in the food-delivery part of the business. Zomato fails to acknowledge this in the DRHP. Even if we calculate say two containers (irrespective of the size) per successful delivery, that accounts for 403 million orders for the fiscal of 2020. Over 800 million containers of plastics and foils (irrespective of the size) in one year alone.

Waste:

Food wastage is a critical issue in the restaurant business as well as the food-delivery business. Though Zomato does not report on this, there is a high probability that some low percentage of refunds generated by Zomato to its customers and restaurants might be a valid proxy for the food wastage incurred.

Emissions:

Delivery partners in India primarily use two-wheeler automobiles to deliver food to customers. Each delivery partner is assigned an area of about 5 kilometres as the radius of food delivery. The company had an active delivery partner base of 167,637 as of December 2020, fulfilling 400 million orders (based on fiscal 2020 numbers). The math comes out to 200 orders per month per delivery partner. Assuming the average mileage of the automobile to be 40 km per litre, average distance per order delivery to be 3 kilometres, the math equates to 23 litres of petrol per delivery partner per month.

Extrapolating the data point of 23 litres of petrol per delivery partner per month, it equates to 3.7 million litres per month across all delivery partners, and a yearly consumption of 45.2 million litres of petrol. Using the GHG Protocol emission calculator (global standard), using 2.27 Kg carbon emission per litre of petrol, the total GHG emission value from delivery partners alone comes to 102.8 million kilograms of TCO2 per annum. This number is quite huge, with no risk mitigation in place by Zomato.

Supplier Environment Assessment

Besides a tiny fraction of the HyperPure business (ZIPL - Zomato Internet Private Limited that provides best-quality ingredients and kitchen products) which includes a section on providing eco-friendly packaging and cutlery to the consumers and restaurant partners, there is no work being disclosed regarding the work by Zomato in ensuring environment-friendly suppliers.

Recommendations:

Some of the key things that can be immediately looked into are

Extended Producer Responsibility strategies for the plastic and foil waste,

investments in carbon offset technologies and interventions,

Shifting to electric bikes in the future for food delivery

Increasing the efficiency of delivery route optimisation and transaction management systems.

A robust restaurant environment performance matrix can be created, and some avenues of eco-friendly packaging for restaurant partners as a part of the onboarding process can be explored.

A dedicated vertical in tracking sustainability parameters and active disclosures of these environment parameters will be a key-value driver towards creating a sustainable business by Zomato.

Social Performance - Community Engagement

Zomato has consciously engaged in Corporate Social Responsibility, with a core committee (comprising of the CEO - Deepinder Goyal, TARI Founder - Kaushik Dutta, and Airveda founder - Namita Gupta) and CSR policy in place. Their work in CSR spans the following:

Zomato Feeding India in collaboration with Hunger Heroes

Zomato Feeding India, a collaborative initiative with Hunger Heroes, a non-profit organization, having a vast network of volunteers across several cities, that work towards its mission of ‘better food for more people’ and ‘zero hunger’ to take the dream of ending hunger a step closer to reality. The purpose of Zomato Feeding India is to leverage our relationship with the food industry, and our community to be able to provide food to millions of underprivileged people in India who run the risk of dying from hunger.

Zomato Feeding India, has been striving to make India hunger free through its several initiatives across multiple cities . Further, our customers get a chance to participate in such causes by choosing to donate a nominal amount on every order they place with us.

Started in January 2019, the society registered as “Hunger Heroes” has actively worked towards reducing food waste and work on better food for more people, with its core focus on SDG 1. Having a network of over 26,000 volunteers spread across 100+ cities, this non-profit has rapidly expanded in the past two years.

OBSERVATION: Zomato extended a loan of INR 50 Crores to Hunger Heroes in April 2021 to fund the intiative of providing hospitals and families with oxygen related infrastructure, other medical equipment, and other supplies.

It is very interesting to observe a corporate providing a loan to its non-profit entity, which it then discloses “we may not be able to recover the amount from Hunger Heroes” in the DRHP. This move is not seen frequently in the social impact sector. This also circumvents the FCRA amendments, and might also contribute to either a writeoff of INR 50 Cr from Zomato’s books, or additional interest income for Zomato. In both cases, the outcome though interesting may not be the best approach.

Recommendation: With the growing network and revenues of Zomato, the company can look into a dedicated team that works on CSR and sustainability initiatives of Zomato. Some of the key initiatives they might be able to explore are as follows:

Nutrition: Focus on nutrition supplements and nutrition-based awareness and food delivery, especially to the communities in urban slums across metros, as well as tier 2 and tier 3 cities.

Social Business Model: Move away from a volunteer approach, and engage with the local communities in building their capacity to take care of the interventions. One of the ways this can be explored is the social business model of looking at low-cost food canteens and food delivery.

Skilling Initiatives under EICI (Express Industry Council Of India): Skilling of low-income households in urban areas in some avenues available under the EICI can be explored, that provides synergies with the overall corporate vision and growth trajectory.

Governance - Anti-trust and Anti-Competitive Behaviour

One of the interesting observations in its disclosures on company risks was the following paragraph:

We have entered into, and will continue to enter into, related party transactions which may potentially involve conflicts of interest.

In the ordinary course of our business, we enter into and will continue to enter into transactions with related parties. For details regarding our related party transactions, see “Other Financial Information - Related Party Transactions” on page 308. While we believe that all such related party transactions that we have entered into are legitimate business transactions conducted on an arms’ length basis, we cannot assure you these arrangements in the future, or any future related party transactions that we may enter into, individually or in the aggregate, will not have an adverse effect on our business, financial condition, results of operations, cash flows and prospects. Further, any future transactions with our related parties could potentially involve conflicts of interest which may be detrimental to our Company. There can be no assurance that our Directors and executive officers will be able to address such conflicts of interests or others in the future.

Though this is standard practice for companies to disclose in their IPO offerings due to the “arms-length basis” transactions, this was accompanied by a show-cause notice by the leading anti-competitive watchdog in India called the Competition Commission of India (CCI).

“Our Company has received a show cause notice from the CCI on December 21, 2020 in relation to the Uber Eats India Assets Acquisition. In the notice, the CCI has called upon our Company to explain why the Uber Eats India Assets Acquisition was not notified to the CCI for its review and approval under Section 6(2) and other approval provisions of the Competition Act and merger regulations framed thereunder.

The penalties might be up to INR 10 Cr. The response provided was as follows:

During the period ended 31 December 2020, the Group has been served with a notice by Competition Commission of India under Regulation 48 of the Competition Commission of India (General) Regulation, 2009 read with section 43A of the Competition Act, 2002 (Act) in relation to the acquisition of Uber Eats and acquisition of shares in Zomato by Uber India.

The management believes that this transaction is not covered in the regulation 48 of the Competition Commission of India (General) Regulation, 2009 and believes that these legal actions, when ultimately concluded and determined, will not have a material and adverse effect on the Company’s results of operations or financial condition.

This squarely falls under the bracket of avoidable risk which the company could have undertaken by following the requisite norms laid down by the CCI.

The Way Forward

As Zomato moves towards its IPO listing, the company’s growth trajectory has been impressive. I strongly believe in the concept of building a sustainable business. One of the key learnings of my time spent with Tony Henshaw (Ex-Chief Sustainability Officer of the Aditya Birla Group) has been,

A sustainable business is one that can live within the constraints of a two degree sustainable world. A business that can reduce its impact on the externalities, as required by the shrinking legal space within which it must operate, as well as one that can adapt to external factors that are driven by global megatrends that will inevitably affect it.

There is a lot that Zomato needs to do especially on the environment front. I believe the company has the intent to invest in innovations and change management as indicated in the DRHP. Some of the recommendations I have outlined above might be a good place for the company to start.

I am happy to provide additional analysis on each of the ESG parameters outlined in this separately. Please do reach out to me at aashir.sutar@gmail.com with your comments, feedback, and recommendations.